I’ve been hearing about Realty Mogul for years, but I’ve been a bit behind the curve and just checked them out recently.

…and I was sure surprised! (in a good way.)

I liked them a lot so I decided to write a review of RealtyMogul.

There are well over 80 crowdfunding sites out there, and the most aren’t really that good. Unfortunately, most review sites simply pick the ones with the highest affiliate payout and rank them.

Because of my experience with RealtyMogul and others, we’ve created one of the most stringent sets of grading criteria on the web for crowdfunding platforms and we review as many crowdfunding sites as we can.

This strict and well-documented methodology helps us avoid potential conflicts of interest, and you can see the methodology with the link above. We have 11 overall categories and rank every company based on the information we have and weight the responses based on what we believe is most important.

So, check out the criteria and read the review below about the company and how it stacks up against its competition.

RealtyMogul – Intro to the Company

This platform was founded in 2013 and is for both accredited and unaccredited investors.

Realty Mogul tends to invest in apartment buildings, retail centers and class A office buildings. The minimum investment amount is $1,000 and fees range from 0.30% to 0.50%. They offer both debt and equity investments and have what is called “private REITs” which are similar to REITs sold on the stock exchange.

To date, they have over 130,000 investors, borrowers and sponsors. Realty Mogul has provided financing to over 135 properties and loans amounting to $280 million.

Disclaimer: This article may contain affiliate links. If you sign up through a link on this page, I may be compensated a small amount at absolutely no cost to you.

Why Try Crowdfunding?

I’ve been in love with the idea of crowdfunding since well before the JOBS act in 2012. I’ve always loved the idea of being able to bring a lot of different people into any deal I’m doing, and I have money invested in other deals and on crowdfunding platforms.

The problem is that real estate tends to be far behind other areas. Real estate is very slow and even slower to adapt or change. So, it was last to the game for crowdfunding as well.

Syndicating has been around for almost 100 years, and crowdfunding is closely related to that. But, people are slow to invest in these and developers are slow to bring on partners.

Why can tech startups find hundreds of millions of dollars in funding practically overnight, even for terrible ideas, but real estate is reserved for a very small and elite group, even when the potential projects are amazing?

That’s how crowdfunding shakes things up. If you’d like a more detailed look about how crowdfunding works, check it out here.

So, if you are an experienced investor currently and want to diversify or simplify your portfolio, online investing is a great place. On the other hand, new investors might find online investing a great place to start!

Let’s dive in:

RealtyMoguls Accreditation Requirements

A few years ago RealtyMogul was for accredited investors only. Fortunately, the SEC revised Regulation A and released Regulation A+ which made crowdfunding available to non accredited investors as well.

It’s quite complicated and new, so many companies chose to stick to Regulation D, which allowed crowdfunding but for accredited investors only. But, with the surprise updates of Regulation A+, it further simplified the process and many companies dove right in.

RealtyMogul is one of the first companies in the real estate space to use Regulation A+ to bring online offerings to everything (accredited and non-accredited people).

This is huge news, because just a few years ago, real estate investing was reserved for those who already had a lot of wealth or income. Now, anyone can get in on the action.

How Does RealtyMogul Find and Screen Investments?

A company such as RealtyMogul can receive hundreds of requests per week. If you look at the total number of deals they complete, it would mean less than a percent or two actually get through the entire underwriting process.

1) Sponsor Screening

The first thing they look at is the company and the sponsors. In general, they want companies that are well capitalized and a history of success in previous deals.

This is a really important part because the managing partner is the most essential part of any real estate deal.

2) Initial Project Due Diligence

RealtyMogul is focused on medium term projects that generally last from 3-5 years. Their preferred structure is equity. RealtyMogul investors are senior to the sponsor and generally must get paid back their principal before the deal sponsor is compensated.

If there is a preferred return, the principal plus preferred return needs to get paid first before the sponsor receives compensation.

At first glance the project needs to meet basic underwriting criteria as well as meet their requirements for market, location, property type, etc.

3) Detailed Underwriting

If the sponsor and project meet the RealtyMogul requirements, it moves on to the detailed underwriting. The RealtyMogul underwriting team completes an extensive analysis and review of all these points.

This is one of the most important steps because they are doing a lot of work that the investor would normally need to do, but often doesn’t know how to do.

This extra layer of diligence is great for protecting the investor.

4) Investment by RealtyMogul

Once all the requirements are met, the investment is put up on their platform and open for pledging.

You are given all of the information to review to make a decision if you want to invest or not.

Choosing How to Invest With RealtyMogul

There are two basic ways to invest which we’ll cover in this RealtyMogul Review.

The two ways are their equity investments or their MogulREIT.

Review of RealtyMogul Equity Investments

The original way to invest with RealtyMogul (and the most common) is with their equity investments.

RealtyMogul puts together a single purpose entity which you fund, then this entity invests in the asset. As money is received from the deal sponsor and investment, it is then broken up and returned to investors.

This option is reserved for accredited investors only. Now, in case you’re wondering what an accredited investor is – in a nutshell, it is a person who earns over $200k per year ($300k if married filing jointly) or who has over $1m in assets excluding their primary residence. You only need to fit one, not both requirements.

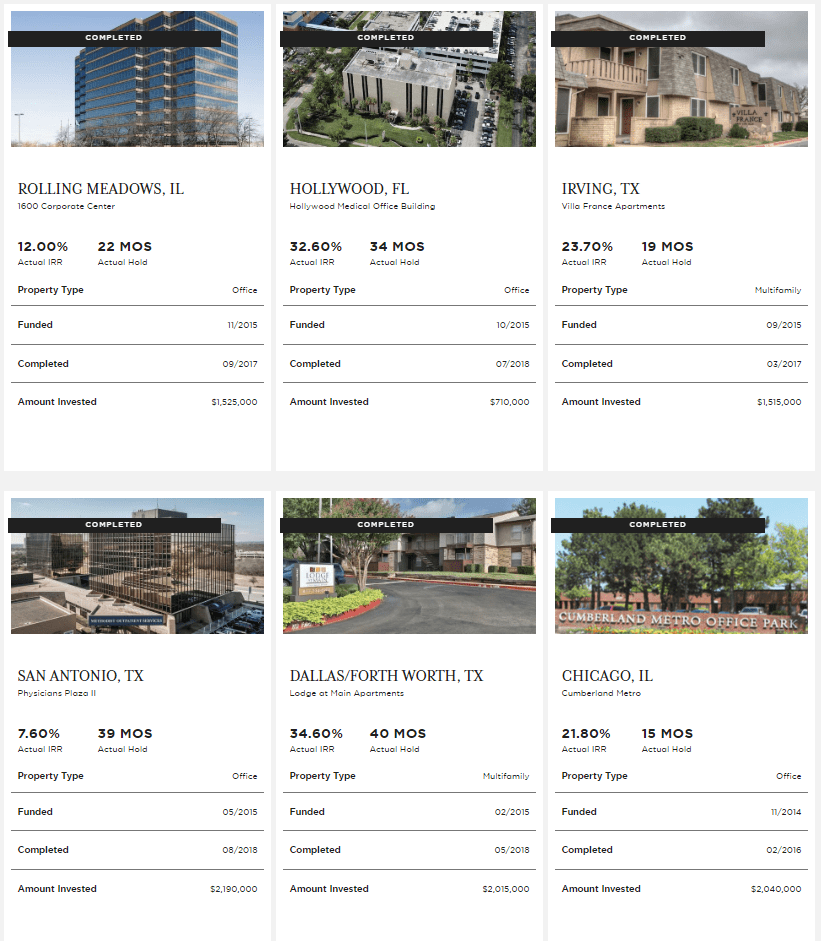

Here is a picture of some past projects they have funded, and the actual returns given to investors.

As you can see, some projects don’t return a lot, but some projects have great returns.

The worst project I could find had a return of 7.6% (in the picture above) and the best performing one had an average yearly return of 48.5% (no pictured above).

I think that these are pretty solid returns overall!

You can see all of their current and past offerings here.

MogulREIT Review

Currently, RealtyMogul has two REITs, called the MogulREIT I and the MogulREIT II. The newest one hasn’t been established for very long, so we’ll focus on MogulREIT I just so we can review something that has a bit longer of a time-frame to give more accurate results.

The MogulREIT is comprised of a number of assets inside of the REIT to reduce the risk you would take if you invested in one large asset.

So, for as little as $1,000, you could be buying into 10 or 20 different buildings. This is great because it preserves your capital should any one deal go bad.

The MogulREIT I is comprised of senior debt, mezzanine debt, preferred equity. The majority of the portfolio is some form of debt, with only around 30% being in equity.

Going back to our basic market knowledge, debt gets a lower return because it is a safer investment.

They are also diversified across multifamily, industrial, retail, and other real estate asset classes.

MogulREIT Returns

The MogulREIT II hasn’t been around long enough to have a good return history to review, but the MogulREIT I has an average return of about 8.25%.

While this isn’t as high as some straight equity investments, adjusted for risk, it is probably fairly attractive. It’s above the S&P 500 average return of 7%, but is comprised mostly of debt (which is safer).

You can see the entire portfolio and return expectations of the MogulREIT here.

A REIT has a lot of regulations surrounding them, and there are a lot of requirements in order to qualify as a REIT. First, they need to distribute roughly 90% of its taxable income to the shareholders.

There are also different types of REITs, such as a publicly listed REIT or non-listed REITs. These MogulREITs offered by RealtyMogul are non-traded REITs as they are not listed or traded on the stock exchange.

According to FINRA, there are a number of risks associated with non-traded REITs, the biggest of which is that it can be very difficult to get your principal back. Other issues are potentially high fees, especially on the front-end and a limited secondary market to sell your shares. In fact, you can read a very scathing review of non-traded REITs if you’d like.

You should read their disclosures in great detail before investing.

RealtyMogul Fees

What RealtyMogul Review would be any good without talking about the fees?

The fees vary by investment type and here you can see all of the RealtyMogul fees. Simply click on any of the offerings and the fees are under the FAQ section.

From browsing the offerings, fees tend to range from about 4% on the MogulREIT to about 5.5 % on the equity deals. Fees to vary from investment to investment, so make sure you are comfortable with the fees before investing.

RealtyMogul vs The Competition

RealtyMogul vs other crowdfunding platforms is really what you want to explore. How exactly does RealtyMogul compare in this review against others?

Well, at the time of this writing there are 11 categories which we rank each platform with. Here they are and where RealtyMogul stands:

- Is RealtyMogul available in all 50 states? – Yes

- Do they prefund deals? – Often

- Fees? – 4%+

- Minimum Investment? – $1,000

- Co-Investing? – No

- Bankruptcy Protection? – Yes

- VC Funding? – Yes

- Non-Accredited Investors Allowed? – Yes

- Diverse Property Types? – Yes

- Equity Investments? – Yes

- Debt Investments? – Yes

Overall, RealtyMogul is one of the top crowdfunding platforms that we review. We give a 5-Star review to the top 5% of platforms, which RealtyMogul has received.

In case you are wondering, here is some information on the other 5-Star crowdfunding platforms as well.

Equity Multiple

Equity Multiple is focused in bringing institutional grade investments to average investors. So, very large apartment complexes, retail centers, office buildings, etc.

The minimum investment is between $1,000 and $5,000 generally, but it varies by deal.

Learn more about Equity Multiple here.

Fundrise

Fundrise is one of the early successes in real estate crowdfunding. This platform allows unaccredited investors the opportunity to invest in commercial real estate. The minimum investment amount is $500.

Learn more about Fundrise here.

What I Like About RealtyMogul

I like how they have seemingly higher returns than other platforms.

Most other platforms are for REITs or for accredited investors only. RealtyMogul has both, which gives a little something for everyone.

What I Dislike About RealtyMogul

While they do have higher returns than what I’ve seen elsewhere, they also have higher fees.

They don’t have a ton of offerings at any single point in time, so you have to keep checking back every week.

Frequently Asked Questions About RealtyMogul

I’m always getting emails and comments about different crowdfunding platforms, so I figured I’d compile some of the more common ones.

Is RealtyMogul a Scam?

I obviously do not own the company or have insights behind the scenes, but no, I do not believe they are a scam.

I’ve seen them grow over the last few years and they have acquired new properties, new investors, etc. They have gone from a tiny company to one of the first to bring a reg A+ REIT to the market.

That does not mean you will not lose money. All investments can lose money. Even if you lose money it doesn’t make it a scam.

Can I Withdraw My Money Once I Invest in RealtyMogul?

The answer is yes, but with caveats.

Certain deals, such as the straight equity deals, there is absolutely no guarantee that you can withdraw any money after you invest. You can always request an equity buyback, but there is no promise.

With the MogulREIT, it’s a little more structured. During the first year, there is no repurchase allowed, but after year 1, you can request for them to repurchase your shares at a % of their value.

Years 1-2 you can get 98% back. 2-3 years it’s 99% and after 3 years it would be 100%.

This is actually a lot more generous than most REITs and has a higher percentage allowed than others.

They do have the ability to reject or delay a withdrawal based on the availability of fund in the account.

The best thing for you to do is to read the offering curricula for each deal you want to invest in, and see what the withdrawal and fee schedule look like.

You’ve Read the Review

Now it’s time to go check out Realty Mogul for yourself.

Eric Bowlin has 15 years of experience in the real estate industry and is a real estate investor, author, speaker, real estate agent, and coach. He focuses on multifamily, house flipping. and wholesaling and has owned over 470 units of multifamily.

Eric spends his time with his family, growing his businesses, diversifying his income, and teaching others how to achieve financial independence through real estate.

You may have seen Eric on Forbes, Bigger Pockets, Trulia, WiseBread, TheStreet, Inc, The Texan, Dallas Morning News, dozens of podcasts, and many others.

Leave a Reply