Have you ever wondered how to start real estate investing so you can escape the rat race and retire early? It’s pretty well established that most millionaires have substantial real estate portfolios.

Not only is real estate an excellent hedge against inflation, but it’s also an excellent way to earn a regular check every month. That’s why a lot of people dream about it. But few ever take action.

Real estate investing isn’t just about buying houses and fixing tenant problems. That’s why it’s important to consider the myriad of ways to get started investing in real estate before diving in.

On one side there is a way to invest that requires a ton of work, but provides very high returns. On the other side, it can be completely passive but has much lower returns. Then there are many options in between We’re going to go over everything you need to get started investing in real estate even if you’re brand new and inexperienced.

- What is Real Estate Investing?

- What are the Benefits of Investing in Real Estate?

- Different Ways to Invest in Real Estate

- Can I Invest in Real Estate With a Full-Time Job?

- Can I Invest With No Money?

- Do I Need a Real Estate Coach or Guru?

- How to Invest in Real Estate – The Ultimate "How to" Guide.

- Can Real Estate Help Me Retire Early?

- Best Real Estate Investing Books For Beginners

What is Real Estate Investing?

The purpose of any investment is to generate long-term growth of capital. It can come either through appreciation of the asset or income derived from the asset.

Real estate investments or stocks operate very similarly if you boil it down to the basics. Price appreciation in real estate is akin to a stock going up in value. The income from the real estate investment is just like dividends paid by a stock. The key difference is real estate investing tends to provide a high dividend but lower appreciation than the stock market.

Real estate is often associated with the management of those assets which includes collecting rents, leaks, clogs, etc. These are important parts of managing a property and should never be ignored. The great part about the real estate industry is there are many ways to invest in real estate, some of which require management and others which are hands-off

But, it’s important to know that management is “work” and is not part of “investing”. If you plan to manage your investments, you should still set aside a cost category for management and pay yourself for the job you’re taking on. If you don’t want the job, pay someone else to manage the assets for you.

What are the Benefits of Investing in Real Estate?

All investments have the goal of growing in value over time, but real estate investments have some additional benefits that you may not be able to find anywhere else.

To remember the benefits, think of the phrase “Real Estate is the IDEAL Investment” where IDEAL is an easy acronym to remember.

Income From Rents

Any investment should appreciate over time, but most provide little to no regular income. Even an excellent dividend-paying stock may only offer 2-3% dividends, with only a few notable exceptions. Comparatively, real estate provides a massive dividend for the value of the investment.

One of the biggest draws to real estate is the monthly or quarterly income that can provide a stable source of income for a family to live on. Also, it’s quite common for a rental property to provide 8-12% cash on cash return, or much higher if you actively manage it yourself.

Read More: What is Cash on Cash Return and How to use it.

Also, you have a lot of control over the income as you can invest in your building with some upgrades, and raise rents to maximize profits. Alternatively, you can hold rents stable during difficult economic periods to keep good tenants and maintain cash flow.

Depreciation on your Taxes

It’s generally accepted that real estate prices in most markets tend to appreciate over time. But, there is a special tax benefit given to real estate investors that allows you to depreciate your assets over time. So as your property value goes up in real life, you get the benefit of writing off losses each year as the IRS sees it’s value as declining.

Also Read: Stocks vs Real Estate

Additionally, most new things you put into the property can be depreciated more rapidly if you choose to track it. For example, an appliance may depreciate over 5 years. Each item has a different depreciation schedule and you can more rapidly depreciate them if you are willing to do the work

Another interesting move real estate investors can do is what’s called a “Cost Segregation” study which allows you to pull depreciation forward and write off much larger portions of the value up front, thus allowing you to take larger losses on paper in year 1. This could help you offset gains on a sale in the same year.

1031 Exchanges

The biggest drawback to taking depreciation write-offs is you will have to pay taxes on that upon the sale of the asset. Fortunately, they have created an entirely separate loophole for us to take advantage of, and that’s called the 1031 exchange. This allows you to sell your building and pull the depreciation into the next building you buy, as long as you follow the IRS rules surrounding it.

Read More: How to Benefit from a 1031 Exchange.

Equity Pay-Down

One of the benefits of having an investment property with tenants is the tenants pay your bills. While leverage is available on many asset classes (such as stocks), none of those assets have the cash flow to pay down the leverage. That’s the benefit of having rental property for your investment portfolio.

So, you get to own the asset and appreciation while someone else pays not only your interest but also pays down your principal balance.

Think about it this way – you can get a decent return on your real estate investment just from cash flow, but you are also building up equity.

Appreciation

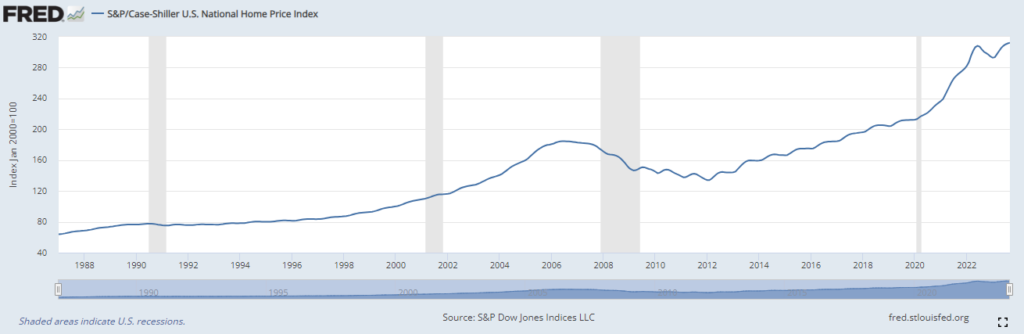

We briefly mentioned it earlier, but in general, most properties in most markets tend to appreciate over time. This is market and property-specific, but in general, this is well-established as true. One of the most popular measures of real estate values is the Case-Shiller Index. Look at the graph below.

The Case-Shiller index was established by two well-known economists who gave their names to the index. They take the average price of houses in the United States and then adjust it for inflation. As you can see, prices are generally stable and appreciated over the long term.

Some graphs go back to the early 1900s and show similar inflation-adjusted stability.

Leverage

You can get leverage for other investments, such as with stocks, but when stocks are going down and you need it the most, they call the leverage and sell your stocks right out from under you.

In real estate, it has one of the most developed debt systems in the world. Leverage is plentiful, cheap, and easy to obtain. Additionally, it has a specified term and the debt cannot be called even if market conditions or values change.

Different Ways to Invest in Real Estate

Real estate is a massive field that has hundreds of different real estate niches. At the beginning of this article, it was mentioned that there are a variety of ways to invest in real estate – from hands-on to completely hands-off, and everything in between.

Investing in real estate breaks down into three rough categories:

- Active investing – Includes house flipping, rental property management, short-term rentals, wholesaling, etc.

- Passive investing – includes private lending, being an LP in syndications, crowdfunding a deal, etc.

- Hybrid – This usually means being actively involved in some aspects of a deal while outsourcing day-to-day management to a property manager.

Active Real Estate Investing

Active real estate investing means you are going to be involved regularly with the operations of the investment. It’s a little dicey to categorize ‘active’ investing as some activities are clearly under the category of speculation or business operations and far outside of the core category of investing.

Regardless, we’ll cover all the major categories that people consider to be real estate investing.

Wholesaling

Wholesaling is the least amount of investment and the most amount of work that we will cover as real estate investing. It involves acquiring a contract on a property and then selling that contract to another investor for a profit. Since the contract is an interest in real estate, and is an asset, it counts as real estate investing.

The process for wholesaling is pretty straightforward:

- Lead Generation – Targeting properties that may have sellers that are motivated to sell below-market value

- Deal Analysis – You need to know the numbers inside and out if you want to know how much you can offer.

- Contracts – Make sure the offer is valid, binding, and allows you to transfer the contract

- Due Diligence – Make sure the scope of work is in line with your estimates

- Finding a Buyer – Building a buyers list and marketing to them

- Close The Deal – Make sure the assignment is valid and also priced appropriately

House Flipping

When people hear the term “real estate investor” they most often think of house flipping because it’s been popularized on TV. House flipping is also one of the most active forms of real estate investing. In reality, it’s less about investing and more about real estate speculation put together with project management. But since it’s popularly known as investing, we’ll include it.

In a house flip, the investor purchases a property, improves the value of the property in some way, and then sells it for a profit. These are generally short-term projects which are often bought, fixed, and sold in under 6 months. The longer a project is held onto, the more it costs and the less profit the investor makes.

The steps to a house flip are:

- Prepare – Have all your ducks in a row so when you find a deal you can make a move on it fast.

- Procure – Finding the right deal and paying the right price for that deal

- Reposition – This could be anything from a touchup painting and carpets to a full rehab or even a tear-down rebuild. This is where you bring the property from the old value to the new value.

- Sell – Give your property an appearance that will make the buyer envision themselves owning it and living there then list and sell for the right price with the right terms.

The most important part of flipping a house is actually the work you do upfront. Deals are won or lost based on your ability to take quick action, that’s why you really need to focus on preparation.

Rental Property

Owning rental property as an investment truly rides the line between active and passive. You have a lot of control over the asset so you can outsource most of the management and work if desired. As such, it can be very active, very passive, or anywhere in between.

It’s still under the ‘active’ category because even if you outsource the management, it does require a bit of work to find the right property, and strategically upgrade or repair the property. Also, you have to stay on top of maximizing your rent and profits.

There are a few common ways that people tend to invest in rental property. For ease, we will call them the Buy and Hold or the Buy and Refi.

Buy and Refi – We are going to loosely use this term to describe the various methods people use to buy a rental property, add value to it in some fashion, and then do a cash-out refinance. This is done to reduce the overall equity in the deal which juices the cash on cash returns.

Buy and Hold – This will reference any strategy where you buy a property at or near fair market value, do little if any work to it, and then just collect rent for a long-term period. Even though the prior strategy also plans for long-term holding, the difference is buy and hold strategy is more about “parking” money than having a strategy to force appreciation through upgrades.

Read More: How Much Profit Does a Rental Property Make

When people think about rental property, they’re usually thinking about the homeowner who moved into a bigger house and is now renting out their old house. That, or large apartment buildings. But, there are dozens of different types of rental property to invest in. Now we’ll break down a few of the major rental property investment niches that people invest in.

Student Rentals

Student rentals are a lucrative investment niche for two primary reasons – rents are higher and evictions are lower.

Generally, students get roommates so the rental rate per bedroom can be much higher for college students than for a normal family. In some situations, you can even rent out per bedroom.

Another great benefit is you rarely need to go to court to evict a student. This is for two primary reasons. The first is that the student’s parents always cosign the lease. So, if they don’t pay you just go after the parent who is very likely to pay. The second reason is evictions are lower because the student doesn’t want to stay there anyhow since they probably aren’t local to the area.

The drawback is a higher vacancy rate. Some students will try to abandon the apartments at the end of the school year and skip out on rent during the summer. You can avoid this by having the parent cosign.

Some costs tend to be higher as well such as property management, insurance, and even lending costs.

Short-Term Rentals – AirBnB and VRBO

This has been exploding in popularity in recent years and has turned into its very own niche. While vacation rentals have existed forever, there has never been an easy way to rent out a room or apartment for a short period of time, easily and efficiently.

Airbnb and VRBO make it easy for people to rent apartments when they travel just about anywhere. Airbnb works well in a lot of situations, such as traveling for work, a conference, etc, but it does have a lot of fees and expenses. VRBO is usually associated more with vacation rentals such as houses near the beach or ski mountain.

The rent on a short-term rental can easily be 3-5x (or more) of renting the property out as a standard rental with a year-long lease. The expenses are substantially higher and there are some political risks involved, as many cities and towns are beginning to ban or tax these.

Multifamily Rentals

Multifamily is an excellent niche for rental property investing because you get some economies of scale. For example, if you have 3 apartments in one house, you still have just one lawn to mow. That reduces the cost per unit substantially.

Multifamily do have lower rents than single-family homes, but they are also less expensive per unit, have lower operating costs, have better loan terms and insurance rates, and it hurts your wallet less when you lose a tenant.

Read More: What’s Better – Single Family Vs Multifamily

General Partner In a Syndication

A syndication is an investment vehicle where you pool investor capital to buy any type of investment property. The general partner is the person who finds the deal, secures the financing, raises capital, closes the deal, directs renovations or upgrades, and makes strategic decisions about day-to-day operations.

The equity is composed of General Partners (GPs) and Limited Partners (LPs). The LP side puts up the capital for the deal while the GPs are compensated a portion of the ownership for doing all the work and making the decisions. An investor can be on both sides of the deal and most GPs do put their own capital into the deal on the LP side of the deal.

Sound confusing? We dive into great detail in this article on real estate syndications.

Passive Real Estate Investing

Passive real estate investing is when you are generally not involved with the day-to-day operations of the investment property. You’ll always be involved with investment decisions and rebalancing, as all investments are that way. You may also have voting rights in some deals to make important decisions. But overall, these investments are mostly passive once a decision to invest has been made.

Crowdfunding

Crowdfunded real estate investments are a relatively new way to invest in real estate. The core of the deal is just like a syndication, but the regulations are specific to allow small-dollar investments from non-accredited investors. In some instances, you can invest as little as a few hundred dollars.

This was created in 2012 when the JOBS Act was passed. Since then, it has grown into a huge industry where major players such as Fundrise, EquityMultiple, and others are crowdfunding billions of dollars in real estate combined.

Check out our full breakdown of all the major Real Estate Crowdfunding Reviews.

REITs

A REIT, or real estate investment trust is a specific structure for investing where most of the profits are passed back to the investors, but by doing so gets special tax status. a lot of different types of real estate investments. A REIT can invest in any sort of real estate as long as it distributes 95% of its earnings to shareholders. There are also several other financial tests it needs to pass to maintain its status as a REIT.

The minimum investments vary – there are some exchange-traded REITs where you could buy just one share while other REITs require a minimum of $100k or even more to invest in them.

There are 3 types of REITs – Private REITs, public exchange-traded REITs, and public non-traded REITs.

Read More: What is a REIT and is it a good investment?

Public Exchange Traded REITs

The great part of REITs is there are some known as exchange-traded REITs where you can buy or sell shares through your brokerage account. The benefit is the liquidity and ease of buying or selling. The drawback is the returns are usually much less than private REITs or any other sort of real estate investment. But, if you are only looking for a way to diversify your stock portfolio, this may be a great option.

Public exchange-traded REITs meet all of the onerous requirements of the SEC to be listed on a public exchange. But, they are still a real estate investing trust. Because of that, it’s lower risk because you aren’t trapped in a REIT you can’t sell and there is more oversight. But with that, you should expect lower returns.

Private REITs

These are not listed on an exchange and won’t have the liquidity of a public exchange-traded REIT. They don’t need to report to the SEC and meet all the requirements of being listed, but they can have higher returns because they have less overhead and management expenses.

The lack of liquidity can also make it very difficult for many investors to get their money out of a private REIT. Extreme caution is recommended to make sure you won’t be stuck in a bad real estate deal that you can’t get out of.

Public Non-Traded REIT

These real estate investments have the same requirements as the exchange-traded variety, but these are private REITs.

You can be more confident in them because they meet the heavy requirements of the SEC, but they are very liquid and you cannot sell your shares very easily.

Disclaimer on REITs

FINRA has a pretty big disclaimer about private and non-traded REITs so make sure you read it and understand it.

Non-traded REITs come with significant risk because they are not liquid investments. They often have a lot of hidden fees and they can be very complex investments for average investors.

Make sure you understand what you’re getting into before buying into a REIT.

Real Estate Funds

A REIT is an actual corporation that buys real estate. A real estate fund is a mutual fund or private placement that invests in multiple properties. a real estate fund can buy multiple REITs, individual properties, or other real estate assets based on its investing criteria.

Limited Partner in a Syndication

Syndication is a really popular way of pooling funds to buy large investment properties. Buying apartment communities that are 100+ units is widespread with syndications, but you can buy just about any asset class in real estate.

The passive investors put up the money (limited partners, or LPs) and the general partners (GPs) find the deal, manage it, find financing, and do all the operations.

The LPs get the majority of the returns while the GPs get a fair portion as well for their effort.

If you want to invest passively, being an LP in a syndication is a great way to do it.

Read more about multifamily syndications here.

Private or Hard Money Lending

Slightly different form of investment as you aren’t buying the property itself, but instead you’ll be lending on it. The asset is the note. If you have plenty of money available and want an investment with good returns and much lower risk, then you could become a private or hard money lender.

Active investors always need money to close deals. Often, they turn to private sources of lending since most banks won’t lend on what they deem to be risky assets. So, they get this money from private lenders.

The interest rates paid to private lenders are usually more than double what a bank charges in interest. Additionally, the loan is secured with a lien on the property. So, if the investor defaults, you can foreclose on the property and force them to pay you back.

So, it’s a good way to make a relatively low-risk and high-return investment in real estate… if you have the cash to do it.

Read More: How Mortgages are Underwritten

Can I Invest in Real Estate With a Full-Time Job?

This depends on you and your goals. Flip houses and keeping a 60-hour-a-week job might be difficult. But, investing passively could fit a full-time work schedule.

So, you can invest in real estate regardless of your employment situation, but you’ll have to pick an investment method that fits your current lifestyle.

Follow these steps to figure out what kind of real estate investor you should be

Step 1 – Determine Your Long-Term Goals

This is the most important step, and that is why it’s #1.

You need to figure out where you see yourself in 5, 10, 15 years.

Do you want to be retired on a beach or mountain somewhere? Or, do you see yourself growing a large business and eventually working full-time in your business instead of in a job?

Do you want to move to a larger house in a nicer town or even a new state across the country? Or, are you comfortable where you are?

All of these questions and more are fundamental to answer.

Step 2 – Figure Out What Kind of Real Estate Supports Those Goals

If you invest the wrong way now, you may find yourself with problems in 5 or 10 years related to your portfolio and where you want to be in life.

So, spend the time to decide what kind of real estate investment fits the goals you determined in step 1.

If you want to work in a business and grow it, then house flipping or hands-on rental property is great.

If you see yourself retiring soon and want to be hands-off, then you probably don’t want to get started flipping houses. Instead, you’ll want to invest more passively now.

Can I Invest With No Money?

Of course, you can. People do it every day.

But, you already know that.

The real question to ask is – How to start real estate investing with no money?

No matter what, somebody is paying. It may not be you, but someone has to pay for the project.

So, let’s further refine the question – How do you get someone to give you money to invest in real estate?

Once you answer that question you’ll have the answer to the first question.

There are a lot of ways to do a real estate deal, but it boils down to basically 2 ways to get someone’s money. You either borrow that money, or they partner with you on the deal.

Borrowing Money

It’s really hard to get a stranger to loan you 100% of the money you’ll need to do the project. In general, they will loan somewhere between 70% and 90% of the overall project.

But don’t worry, you’ll have to find another way to get that 10-30%.

Another source of revenue is from friends and family. But I don’t want to borrow money from friends until I know it works! – Said everyone

It’s hard to ask people for money. But, if you want to invest in real estate with no money, you will have to get used to asking for money.

If you don’t have your own money to invest and you don’t believe in it enough to ask friends and family to invest with you, then perhaps you should consider investing differently.

So, the key is to get friends and family to loan or partner with you to give you that 10-30% you need, then go to a private lender for the other 70%+.

Now, your deal is funded.

Partnering on Real Estate Deals

The other way to invest in real estate with little money is to partner with someone else.

But here’s the thing – no experienced investor is going to partner with someone with no skills, no money, and no experience.

The key is to have a skill (or learn one) that people find valuable. Then they will be OK giving you a small piece of their deals if you are bringing that skill to the table.

This is exactly how I landed my first 200-unit deal. Read about that here to get a better understanding of partnering on deals to get started.

Do I Need a Real Estate Coach or Guru?

No one NEEDS a coach or a guru to teach them about real estate investing. But, a good coach can be helpful.

The problem in real estate is some so many gurus give you nothing and take a ton of money from you. They’ll take the money you could have used to get started.

You’ll be left with some mediocre training and no money to get started.

But, a good coach will teach you everything you need to know, help you review deals, and push you to be successful.

A good coach will help you accomplish more than you ever could have on your own.

So, consider it carefully before getting started as a real estate investor. But, do not get sucked into giant crowds of people waving their credit cards.

How to Invest in Real Estate – The Ultimate “How to” Guide.

You’ve stuck with us this far, so now it’s time to get into the really good stuff!

We’re going to cover all the fundamentals of how to invest in real estate. We’re going to start with finding deals. Then we’ll cover analyzing those deals and end with the basic management of your real estate investments.

Finding Good Real Estate Deals

There are only two ways to find an investment property – you find it, or it finds you.

All properties are either listed on something like the MLS with a broker. Alternatively, you can find them through marketing.

So, either the deal is out there looking for you, or you go looking for it.

Working With an Agent or Broker

How this works will depend heavily on whether it’s residential or commercial property. Often, commercial property doesn’t have buyer agents and you’re stuck using whoever the listing agent is.

Residential real estate is different and you can have your dedicated real estate agent to help you search.

The great thing about the MLS or working with an agent is the fact that there are so many deals to look at!

But, they are often priced at the top of the market and there is very little upside potential.

Occasionally a good deal will pop up, but more often the price becomes too competitive because everyone else is going to be bidding on the same properties as you.

Marketing for Real Estate Deals

There are a million ways to find a deal. Some people walk through neighborhoods looking for run-down property. Others do direct mail or even start websites.

If you’re reading this, chances are you have a job currently. So, we want something that is scalable and requires the least amount of time involved. Any remaining involvement should be super flexible to work around your work schedule.

That rules out things like door-knocking and cold calling.

And, it leaves things like direct mail marketing and creating investor websites.

Here are a couple of resources to help you learn about these:

Analyzing Your Potential Investment Property

Deal analysis is the most important part of this whole process. It’s simple, but it ain’t easy.

Determining Your Criteria

The first thing you need to do is figure out your criteria. You need to know what sort of returns you are looking for.

Think about it this way – if you found a deal that paid 10%, would you buy it? What about 11%, or 12%? What is the cutoff?

You need to have that set before you do any analysis at all.

Collecting the Data

To analyze any investment property, you need 4 basic pieces

- Operating Budget

- Rent Prices

- Rehab Budget

- After Repaired Value

With these four pieces of information, you should be able to determine your total return and then decide if you want to purchase it or not.

An operating budget is one of the pieces that just about every residential investor makes a mistake with. That’s because the seller has no idea what it costs and even if they did, they probably aren’t managing the property well anyhow.

Rental Prices are fairly easy to figure out. Start with whatever is in place at this property, then look at all of its neighbors and see what they rent for.

Rehab Budget is easy and hard. It’s hard to estimate on your own. But, it’s easy to get a quote from a contractor.

ARV is determined by running the comps.

Learn more about doing a comparative market analysis.

Napkin Math

Now it’s time to put it all together and create your first-year proforma. Pro forma is simply the total income and expenses if everything runs perfectly.

Total Income – Vacancy = Net Income

Net Income – Operating Costs = Net Operating Income

NOI – Mortgage = Cash Flow

Cash Flow / Cash Invested = Cash on Cash Return.

Analyzing rental property is pretty easy, right?

More Resources:

Managing Your Real Estate Investing Portfolio

Now the fun part – property management.

Management includes everything from finding and screening tenants to doing maintenance and checklists.

There are books out there that are 300-500 pages long that just touch the surface of good property management. So, instead of getting into it here, here is a list of some great resources on this website.

3 Simple Steps to Find a Great Property Manager

Dealing with Tenants and Keeping Them Happy

Can Real Estate Help Me Retire Early?

Real estate is an excellent addition to any retirement portfolioThe reason why most people invest in real estate is to achieve the goal of early retirement.

They don’t want to be landlords.

They don’t want to fix toilets and lights.

People want the income to come in, help sustain their lives, and make them less reliant on their jobs.

While you can be a landlord, do the maintenance, and earn more…

You don’t have to.

The key to having real estate investing help you retire early is to create some passive income, then snowball that extra income into even more investments.

Over time, your investments will keep growing until your passive income exceeds your monthly living expenses.

Best Real Estate Investing Books For Beginners

We have a variety of book reviews on this site. Here is the most popular one to get you started.

Best Real Estate Investing Books

Eric Bowlin has 15 years of experience in the real estate industry and is a real estate investor, author, speaker, real estate agent, and coach. He focuses on multifamily, house flipping. and wholesaling and has owned over 470 units of multifamily.

Eric spends his time with his family, growing his businesses, diversifying his income, and teaching others how to achieve financial independence through real estate.

You may have seen Eric on Forbes, Bigger Pockets, Trulia, WiseBread, TheStreet, Inc, The Texan, Dallas Morning News, dozens of podcasts, and many others.

Leave a Reply