Your real estate broker sent you a great property and pro forma for that real estate. You’ve crunched all the numbers it shows good rents that are growing and stable expenses.

You model it out in your free simple real estate calculator, and it looks amazing!

So, you decide to make an offer and during due diligence you ask for a copy of the actual rent roll and leases. But there’s one problem.

The actuals are way off from the pro forma! The actual rents are way lower, there’s higher vacancy, and expenses are through the roof. How could the actuals be so far off from the real estate pro forma provided by the broker.

Let’s dig into how and why this happens and how you can use the pro forma for your real estate deals.

We’ll also go through a few examples and look into the income and expenses of properties as well as look at pro formas and how they are created. Then, we’re going to break it all down so you know what to look for when working with a real estate pro forma.

Real Estate Pro Forma – Defined

The real estate pro forma is a detailed breakdown of the income and expenses of a rental property once it is fully stabilized and operating at peak efficiency. This means that it has the market rents, income, vacancy rates, and operating costs that are comparable to other properties with a similar class and age in that market.

Often, pro forma rents are calculated based on comparable rentals. Also, they take into account any planned renovations or upgrades being completed. Similarly, pro forma expenses are based on the cost to operate a fully stabilized property and do not include any major upgrades or expenses.

Pro Forma vs Actual Rents and Expenses

As a buyer, you never want to pay more than what a property is worth in its current condition. Sellers are generally looking to get the absolute top dollar for their property that they can get.

Since rental property is often priced based on its income and expenses, it makes sense that a seller will present the most favorable information to you. That’s why they are trying to get you to pay top dollar for a property based on its pro forma rent rather than the actual rents.

Do not be confused, the pro forma is not how the property is operating today. Often, the sellers will inflate the income and reduce costs to have a favorable net operating income and entice offers.

Remember, a commercial property’s value is determined based on the Net Operating Income and the Capitalization Rates in that market for that class of property. Alternately, residential property values are calculated based on comparative sales.

So, your financing will be based on the actual income and expenses and not based on the pro forma. If you want to make an offer based on the pro forma rents and expenses, then you’ll likely end up having to make a larger down payment to cover the difference in value.

Create Your Own Pro Forma

When I’m looking for a deal, I’ll generally take the broker’s pro forma and plug it into my calculator.

I do this as a screening tool. My thought is – if the deal doesn’t work with their amazingly aggressive income and expense assumptions, then there is no way it will work with my more conservative numbers.

If it doesn’t look like a killer deal with their numbers, I immediately toss it. If it looks great on paper, then I move on to the next step and give it a deeper look.

Part of that deeper look is to create your own pro forma.

Pro Forma Real Estate Rents

The first step is to see if the pro forma rents are based in reality or not. You do this by comparing them to the actual rents.

Let’s say for a simple example that you are analyzing a 10 unit deal and all of the units are 2 bedrooms.

The broker is telling you the rents could be $1,000 per month, but the average rent is only $797. There is a big discrepancy, so let’s see if it’s realistic or not by taking a look at the rent roll. Here is an example of the rents you might see:

- $700

- $800

- $825

- $950

- $875

- $1,000

- $835

- $875

- $925

- $890

Pro Formas vs Actuals for Rent

You might think it’s kind of weird for the rents to vary so much, but it’s quite normal. The tenant that has lived there for 10 years will usually pay less than the one who moved in last month.

Also, some units might have additional amenities that are worth more. Ground floor apartments might have a yard. Others might have a washer/dryer hookup for example.

Here, I want to see how many units are rented at or near $1,000 since that is what the broker is saying the rents should be. In this example, we see only 1 unit rented at that level and one more at $950, and one at $925.

Most of the rest are in the $800 range with one outlier at $700.

Without knowing why the one unit is getting $1,000, I’d have to assume it’s an outlier since there is only 1 unit at that rate.

There are 2 units at $875, 1 at $925, and 1 at $950. So I’d feel quite comfortable listing my pro forma rents at $925 because 4 of the 10 units are right around that number.

If I wanted to make a very aggressive offer (for example, I LOVE the area) I would underwrite it at $935 or $940.

Pro Forma Expenses

Pro Forma Expenses include the following expense categories:

- Payroll – Only used in larger buildings with full time staff.

- Repairs and Maintenance – Pretty self explanatory. The costs of repairing and maintaining a property.

- Contract Services – includes things like pest control, waste removal, snow and lawn services etc.

- Make Ready Costs – The cost of turning over the units that go vacant each year. Make Ready is the cost of making a unit ready.

- Advertising – advertising or leasing costs.

- Administrative – Includes taxes, attorneys, etc.

- Utilities – Electricity, gas, etc.

- Property Management Fees – The cost of hiring a property management service. If you don’t hire one, the cost should be included in the pro forma anyhow.

- Taxes – Property and income taxes on profits.

- Insurance – the cost of fair and adequate insurance coverage.

- Reserves – Savings for major capital expenses such as HVAC, Roof, Windows, etc.

The first thing to do with pro forma expenses is to compare it to the 50% rule for real estate expenses. If it’s substantially higher or lower than 50% then you’ll want to dig into the numbers further and figure out why. This is generally seen as a huge red flag.

The reason why we look into it so deeply is because brokers can’t make up random expenses for their pro formas. but they have a number of ways to fudge the pro forma to make it look beter.

Instead, they will make sure the seller is controlling the expenses for 3-6 months before listing the property. Smart sellers will control their expenses for a full year before listing their property for sale. That way the listing agent can make a compelling argument to use a lower set of expenses.

Another way to fudge the pro forma real estate expenses is to justify various expenses as capital improvements, and slide them into the Capital Expenditure (capex) column, which is not considered an expense but is considered an improvement.

On larger deals, you’ll get to see a breakdown of the expenses month by month, so this trend can be discovered by annualizing the expenses over the last 3 months and comparing it to the expenses for the last 12 months. If they are dramatically different, you know they are artificially pushing costs down.

For smaller deals, you’ll be lucky to just get the expenses they put on last year’s taxes, never mind a month-to-month breakdown. So, the only way to compare is to look 2 years back, which probably isn’t going to happen either if you’re working with an unsophisticated investor.

The only thing you can do is get estimates from a property management company, compare them to other properties you own, or compare it to some rules of thumb, such as the 50% rule.

Putting The Pro Forma Together

Once you have your actual income and expenses and your pro forma rents and expenses, it’s time to compare the two and analyze your deal.

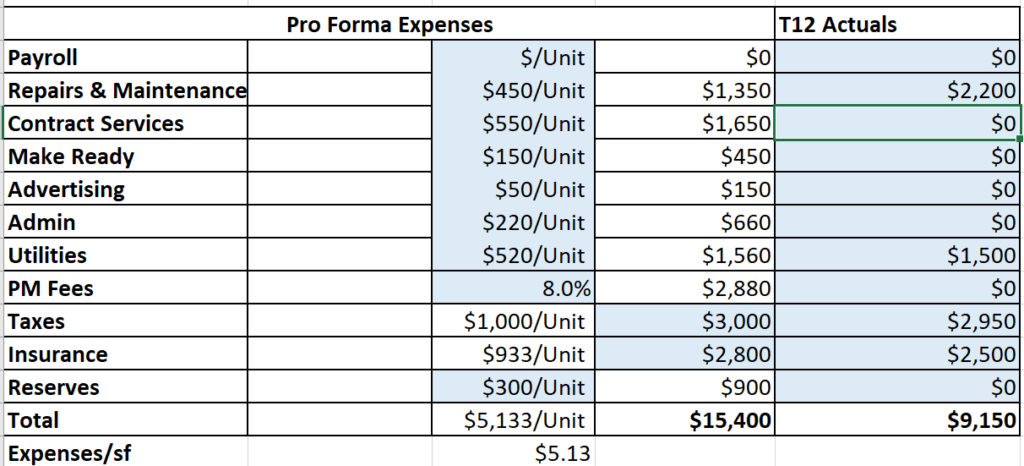

Let’s take a look at this example of a 3 unit building. On the right, under T12 actuals, that is the information the seller has provided. So, punch it into the calculator.

As you can see, the seller doesn’t provide a lot of information. Without a good breakdown of all the expenses, it’s easy to forget what expenses should be there or shouldn’t be. Things like make-ready or admin costs (for eviction, attorneys, accountants, etc), and reserves are often forgotten.

Now that we have realistic expectations for rent and a good budget, it’s time to put it all together.

From Actual to Pro Forma

The last thing to do is to estimate how long it will take you to move from actual rents and expenses to the pro forma projections.

If it will take 18 months, then you need to account for the increased vacancy, turnover, and other costs to get you there over that time frame.

I’ve built this into my calculator to make it easier, but if your calculator doesn’t have it, you can jack up the vacancy rate, or build it into the rent growth assumptions, or any number of ways to work around the limitations of the software.

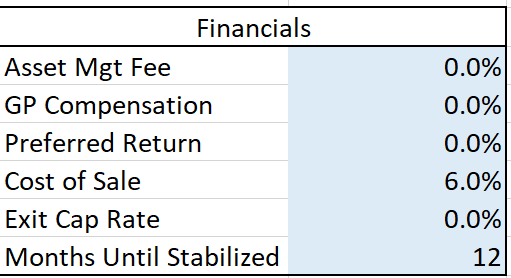

You can see at the bottom, I assumed for this specific project it would take 12 months to finish and bring all rents to the full, stabilized level.

Since this was hypothetical, I’m going to stop the analysis there. But, you can take the information and use it on any deal you find.

How Do You Analyze Your Deals?

There’s a lot of reasons you should be making an accurate pro forma before purchasing your next real estate deal. Do you use a pro forma when running your numbers, or do you just look at the actuals?

Eric Bowlin has 15 years of experience in the real estate industry and is a real estate investor, author, speaker, real estate agent, and coach. He focuses on multifamily, house flipping. and wholesaling and has owned over 470 units of multifamily.

Eric spends his time with his family, growing his businesses, diversifying his income, and teaching others how to achieve financial independence through real estate.

You may have seen Eric on Forbes, Bigger Pockets, Trulia, WiseBread, TheStreet, Inc, The Texan, Dallas Morning News, dozens of podcasts, and many others.

Why use a pro at all