This is a guest post from sparkrental.com.

What if from this day forward, you only ever bought good investments?

One of the great advantages of rental properties over other types of investments is that the returns are predictable. Stocks fluctuate in value, bonds and notes can default on you.

But if you invest properly in rental properties, you’ll know the long-term average costs to expect.

You can literally say “I will only put money into an investment if it will generate a 10% or greater return.”

Granted, housing values can crash. But rents are remarkably resilient, even when home prices drop.

Here’s what rental investors need to know about forecasting cash flow and annual yield.

A (Financial) Year in the Life of a Landlord

Before going any further, it’s worth distinguishing between “average” and “typical” expenses for a landlord.

In a “typical” month, most landlords have no expenses beyond making their mortgage payment. The rent comes in, the mortgage goes out – the end.

But “typical” doesn’t tell you much about the actual returns.

Landlords’ returns are based on long-term averages of large – but irregular – expenses. A $5,000 roof bill. A $4,000 turnover. And so on.

Newbie landlords are always saying things like “Well, this year the property didn’t perform that well, because I had to replace the furnace. But next year we’ll be back on track!” Then next year the property sprouts a major plumbing leak, or the tenants move out and leave damage, or the property sits vacant for two months.

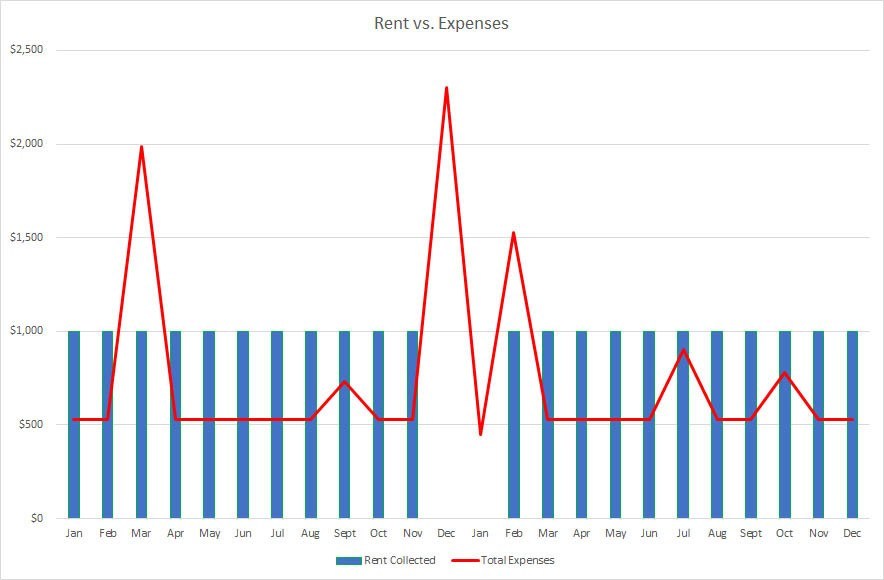

Here’s a graph I like to show my students, in our rental investing and landlording courses:

These are two years of actual income and expenses for a rental property I used to own. You can see the baseline mortgage expenses from a “typical” month – then you see the expenses periodically spike.

The lesson is simple: landlords need to calculate the costs of irregular-but-inevitable expenses when forecasting their cash flow.

Here are some of those expenses, that every landlord incurs sooner or later.

Vacancy Rate (and How to Forecast It)

Vacancies happen.

Hopefully not often; if they do, then either you’re managing the property badly (which can be fixed somewhat easily), or you bought in a low-demand market (which can’t).

In a strong rental market, you’ll see vacancy rates under 5%, and in hot markets, they could be under 2%. But in average or cooler markets, they may be closer to 8% (an average of one month out of the year).

In lower-demand rental markets, they’ll be above 8% and can cause real damage to landlords’ returns.

Fortunately, rental investors can determine vacancy rates for a given neighborhood by speaking with Realtors, property managers, and most importantly, other landlords. Before buying a rental property, make sure you have a strong grasp of the local vacancy rate.

Repairs, CapEx, Maintenance

Being a landlord is all fun and games until the roof needs replacing.

We touched on this earlier, and how new landlords are always surprised when repair bills come along. But should they be?

Real estate is, well, real. Properties are physical; they suffer physical damage and decay. Sooner or later, every single component in a property needs to be replaced.

The good news is that these capital expenditures (or CapEx) are somewhat predictable. You know the life expectancy for the type of roof on your property, and the furnace, and the plumbing, and the ductwork, and so on.

As a reasonable rule of thumb, consider setting aside 8% of the rent for CapEx and major repairs.

What about maintenance? What’s the difference between maintenance and repairs?

Painting in between tenancies is maintenance. Annual furnace servicing is maintenance. While every landlord has a slightly different definition, but to me, maintenance has less to do with the physical structure of the property and more to do with ongoing prevention and simply minimizing wear and tear.

Consider setting aside 5% for maintenance, but it will vary by property. Older units tend to require more maintenance than newer ones. A low-end property that constantly turns over will need to be repainted far more often than an upscale unit with stable, high-income renters. Use your best judgment.

Property Management Costs

Warning: rant ahead.

I hear new landlords say it all the time: “Oh I don’t need to budget for property management costs, I’ll be managing the property myself!”

Good for you. Now budget for them anyway.

Why?

Because you might decide you hate managing rentals. Or maybe you give birth to quadruplets and have no time to manage them. One day you’ll be old and won’t want to manage them anymore but may still want the passive rental income to supplement whatever’s left of Social Security in 40 years from now. (I think we can all agree it won’t be what you paid into it.)

But the simplest reason of all? Because it’s a labor expense, whether you’re doing the labor or someone else is.

Rental properties require management. But other types of investments (e.g. equities) don’t – how can you compare returns on them, if you don’t account for the labor expenses incurred with rental properties?

Set aside not just enough to cover the ongoing rent collection fees that local property managers charge (usually 7-10%) but also their fee for placing new tenants (usually between half and one month’s rent).

I usually set aside 12-14% for property management. You’d be foolish not to set aside at least 10%.

All right, rant complete.

Administrative, Bookkeeping, Accounting, Travel

Let’s rewind a few sentences, to where we mentioned that rental properties require active management unlike equities and most other types of investments.

Part of that management involves tracking income and expenses, filing extra schedules and forms with your tax return, tracking communications with tenants. Sometimes you need to physically go visit the property, to do a semi-annual inspection (you do inspect your rental units every six months, right?), meet a contractor, etc.

All that takes time and money. Your accountant will almost certainly charge you more if you have a more complicated tax return that includes rental properties.

Consider setting aside 2-4% for these administrative and miscellaneous rental ownership expenses and labor.

“Is There a Calculator I Can Just Plug My Numbers Into?”

Once you understand the math, there’s no need to give yourself a headache analyzing every single prospective property!

Shorthand: The 50% Rule

“Brian come on man, that’s a lot to calculate just to decide whether it’s worth checking out a potential rental property!”

Right you are. Good thing there’s an easy (and surprisingly accurate) shorthand.

Enter: The 50% Rule.

It’s about as simple as it gets: as a rough estimate, you can lump all rental ownership expenses together as about half the rent.

All ownership expenses, except for financing costs (principal and interest).

But everything else, when added together – and we’re including property taxes and insurance here – tend to cost about half of the rent.

Not exactly, and not always, of course. There are exceptions; the higher-end the property, the lower the relative costs of ownership and management tend to be. A property in a gang war zone will have extremely high vacancy rates, turnover rates, maintenance costs, etc.

Alternatively, properties in high-demand, high-rent districts will tend to have lower vacancy rates and so forth. Lower expenses relative to the rent.

But as a general rule in stable working- and middle-class neighborhoods? Count on around 50% of the rent going to expenses.

What Numbers Are Important to You When Buying Rentals?

Always follow the “2% Rule”? Or invest only in properties that will yield a cash-on-cash return in the double digits?

Share your thoughts below!

Eric Bowlin has 15 years of experience in the real estate industry and is a real estate investor, author, speaker, real estate agent, and coach. He focuses on multifamily, house flipping. and wholesaling and has owned over 470 units of multifamily.

Eric spends his time with his family, growing his businesses, diversifying his income, and teaching others how to achieve financial independence through real estate.

You may have seen Eric on Forbes, Bigger Pockets, Trulia, WiseBread, TheStreet, Inc, The Texan, Dallas Morning News, dozens of podcasts, and many others.

Leave a Reply