One very important thing all investors must know is how to calculate the break even ratio. There are a lot of ratios to look at when investing in real estate, and it can get confusing, but the break even ratio and a variety of break even numbers are essential to know before purchasing any deal.

Not only will it help you know if your deal is good or bad, but knowing these numbers allow lenders and other investors to assess the rental property for its ability to meet its operating expenses, debt service, and provide a level of profit. In other words, these ratios make them more comfortable to lend to you or invest with you in your deal.

Here are a few break even ratios that you may be interested in:

- Break even occupancy

- Break even rent rates

- Break even costs

- Break even price

They are all subtle variations of the same concept but each tell a slightly different story.

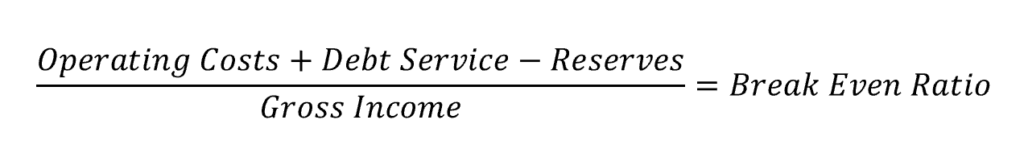

Break Even Ratio Formula

The break even ratio is quite simple at its core. You’re just dividing the expenses by the income to get a number, and that is your break even ratio.

More specifically, simply take the debt service + operating expenses – any reserves and divide by the gross operating income.

Break Even Ratio Example

Let’s say a given property has an annual debt service of $15,000 and it’s annual operating expenses are $12,000. The total yearly expenses for this property are $27,000.

Now, let’s say this property has a gross income of $33,000 (not to be confused with the net operating income).

Total Expenses / Gross Income = Break Even Ratio

$27,000 / $33,000 = 81.8%

So, you need roughly 82% occupancy to break even and cover your expenses.

Break Even Ratio vs Debt Service Coverage Ratio

The Debt Service Coverage Ratio measures a property’s ability to cover its debt obligations with its income. It is calculated by dividing the property’s annual net operating income by its annual debt service. The formula is:

DSCR=Net Operating Income / Annual Debt Service

A DSCR of less than 1 indicates that there is insufficient income to cover debt payments, while a ratio above 1 suggests that the property generates enough income to pay its debts. Lenders often use DSCR to evaluate the likelihood of a borrower defaulting on a loan.

Differences Between BER and DSCR

The primary difference lies in their focus and calculation. BER considers both operating expenses and debt service in relation to gross income, making it a broader measure of a property’s overall financial health. DSCR, on the other hand, focuses specifically on the property’s ability to cover debt obligations with its net income, providing a more focused view of debt management.

Relationship and Interplay

While BER and DSCR are different metrics, they are related and often used together to provide a comprehensive picture of a property’s financial viability. A property with a high BER might still have a healthy DSCR if it has low debt obligations relative to its net income. Conversely, a property with a low BER but high debt service might have a poor DSCR, indicating potential difficulties in meeting its debt obligations.

Both ratios are critical for real estate investors and lenders in assessing the financial stability and risk of a property. They provide insights into different aspects of the property’s financial performance and are essential tools for making informed investment and lending decisions.

When To Use Break Even Ratio

The break even ratio is important for both investors and lenders. It’s used to know what occupancy level you require in order to still cover your bills.

For example, if your break even ratio is 92%, an investor or lender may feel this deal is shaky because of the high occupancy required to keep the building afloat. It’s really common for occupancy levels to drop below 90%, especially during a recession.

On the other hand, if the break-even ratio is 75%, an investor or lender would be far more confident in the deal. They will know that during the worst case scenario of a 25% vacancy rate, the property could still cover all of its expenses and obligations.

Additionally, investors may analyze a deal by looking at the break-even occupancy rate both at acquisition and after the building is remodeled and stabilized.

When To Use the Break Even Ratio – Example

For example, if we are buying a deal with a heavy rehab component, we might expect it is currently underwater or barely breaking even. So, a break even occupancy of 95% or even over 100% would be expected.

We could project out one or two years and look at what the stabilized property would look like. Then determine the break even occupancy at that point.

Let’s say that in year two, the break even ratio is a much healthier 82%. So, we might choose to take this deal.

On the other hand, if we did all this remodeling and work and the break even ratio was 90%, we might reconsider investing in the deal.

Break Even Ratio Rule of Thumb

As a general rule of thumb, lenders will look for a break even ratio of 85% or less. Just like everything else in real estate, this number fluctuates and depends on the lender and property, but a ratio under 85% is good.

This means the total rent collected can drop by 15% and you still can cover all of the bills. That’s pretty good for income producing property.

Analyzing Real Estate Deals

When analyzing your rental property deals, there are a number of metrics you’ll want to use to determine if it’s a good deal.

First, you want to know what it will be worth when any upgrades or rehab is completed. Let’s say you are converting an unused space into a game room with a special area for a pool table and dartboard. Determining that value is called the After Repair Value.

You calculate this by doing a comparative market analysis (if it’s a smaller deal) or by using capitalization rates (if it’s a larger deal).

The next thing you want to look at is the average cash on cash return as well as the overall return on investment over the timeframe of the deal.

You’ll want to look at the in-place cash on cash return day 1 and compare it to the cash on cash return once the work is complete and rents are pushed.

But Why, Exactly?

You do this because you want to walk into a cash flowing property day one, then add value. It’s a lot harder to buy something that is cash flow negative and turn it around.

This is where you’ll look at the break even ratio to see how the deal performs both day 1 and after it’s stabilized.

Now, you’ll want to look at overall financing and how that affects your returns. This is where the debt coverage ratio comes into play. If the DSCR is too low, you’ll get less loan proceeds. That means higher cash out of pocket and lower cash on cash returns.

With all of this information, you can make an informed decision to buy or not to buy.

Eric Bowlin has 15 years of experience in the real estate industry and is a real estate investor, author, speaker, real estate agent, and coach. He focuses on multifamily, house flipping. and wholesaling and has owned over 470 units of multifamily.

Eric spends his time with his family, growing his businesses, diversifying his income, and teaching others how to achieve financial independence through real estate.

You may have seen Eric on Forbes, Bigger Pockets, Trulia, WiseBread, TheStreet, Inc, The Texan, Dallas Morning News, dozens of podcasts, and many others.

Leave a Reply