You want to get into real estate but don’t have much money. So, you do some research on “investing with no money down” and eventually you come across the term “real estate wholesaling.”

A lot of people toss it around as a miracle solution to getting started in real estate for people without any money.

They’re wrong.

Wholesaling real estate is a great way to get started in real estate, but you need to cut through the hype and get down to the nuts and bolts. The fact is, real estate wholesaling does require *some* initial investment, even if it’s pretty small comparatively.

In this article, we will cover every step you need to get started wholesaling real estate.

Since this article is rather long, you can click on any of the following sections and go directly to it.

- Real Estate Wholesaling Explained

- 6 Steps to Real Estate Wholesaling

- Step 1: Finding Motivated Sellers

- Step 1: Build a Real Estate Wholesaling Website

- Search Engine Optimization for Your Wholesaling Website

- Great Resources For Building Wholesaling Website

- Don't Have Time To Worry About SEO Details?

- Free Real Estate Website How-To Guides.

- How to Build a Wholesaling Website

- How to Build a Real Estate Website That Converts

- How to Do Content Marketing

- How to Make Squeeze Pages

- Search Engine Optimization

- Running Real Estate Ads on Facebook or Google

- Direct Mail Marketing

- Step 1: Build a Real Estate Wholesaling Website

- Step 2: Real Estate Deal Analysis

- Step 3: Putting the House Under Contract

- Step 4: Due Diligence

- Step 5: Find a Buyer

- Step 6: Close the Deal

- When You Should (and Shouldn't) Wholesale a Property

- Risks of Wholesaling

- How Much Can I Make by Wholesaling Houses?

- Now It's Time To Take Your First Step as A Real Estate Wholesaler

RealEstateInvesting.org is supported by its audience. We may receive a commission if you purchase a product after clicking on a link on this website.

Real Estate Wholesaling Explained

Wholesaling a house is similar to flipping a house. The key difference is you are flipping a contract rather than flipping the physical asset.

Let me explain.

In a normal real estate transaction you will find a property somehow (either on the MLS, through word of mouth, marketing, etc). You’ll make an offer and the owner will review the offer. Once they accept an agreement called a Purchase and Sale Agreement (P&S, PNS, or PSA). Then you’ll do your diligence, pay your deposits, do a title search, and eventually have a closing where the remaining balance of the money is given and the title to the property is received.

If you get a mortgage or have partners on a deal the steps can be more complicated, but these are the core steps to a real estate transaction.

When the owner signs your purchase and sale agreement, it is said that you now have a “legal interest” in the property. While you don’t own the property yet, you have a tangible and real interest in the property.

The cool part is that any “interest” in an asset is itself an asset.

This leads to all sorts of interesting assets related to real estate such as visibility rights or air rights. But in this instance, your asset is the actual purchase and sale agreement.

And… any interest in anything can be sold.

That’s the crux of real estate wholesaling. You gain an interest in a property and then sell that interest. So, if you have a great contract for a low price, you can sell that contract to someone else because you are selling your interest in the property.

In theory, you can wholesale anything from houses, multifamily, self-storage, cars, websites, or even industrial complexes. But for this article, we’ll stick to wholesaling houses.

6 Steps to Real Estate Wholesaling

For ease of reference, we’ll break wholesaling down into 7 basic steps.

- Lead Generation – Targeting properties that may have sellers that are motivated to sell below-market value

- Deal Analysis – You need to know the numbers inside and out if you want to know how much you can offer.

- Contracts – Make sure the offer is valid, binding, and allows you to transfer the contract

- Due Diligence – Make sure the scope of work is in line with your estimates

- Finding a Buyer – Building a buyers list and marketing to them

- Close The Deal – Make sure the assignment is valid and also priced appropriately

Step 1: Finding Motivated Sellers

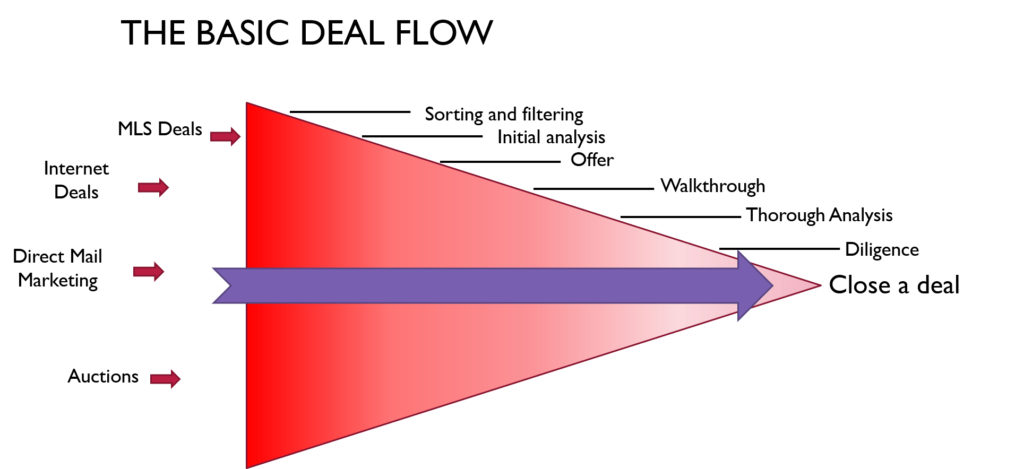

The first part of the business is to fill your deal pipeline. It’s all a numbers game, so more leads mean more deals closed.

Your deal funnel might look a little different than this one, but everyone follows a generally similar model.

So, if you can find more leads through a variety of methods, then you’ll ultimately close more deals.

While you can find deals via any lead source, investors tend to not like it when wholesalers send them deals that are already on the MLS. So, avoid this unless you can negotiate some crazy numbers and terms.

There are two really common ways to find motivated sellers, and that is through direct mail marketing, and with a lead generation website.

Step 1: Build a Real Estate Wholesaling Website

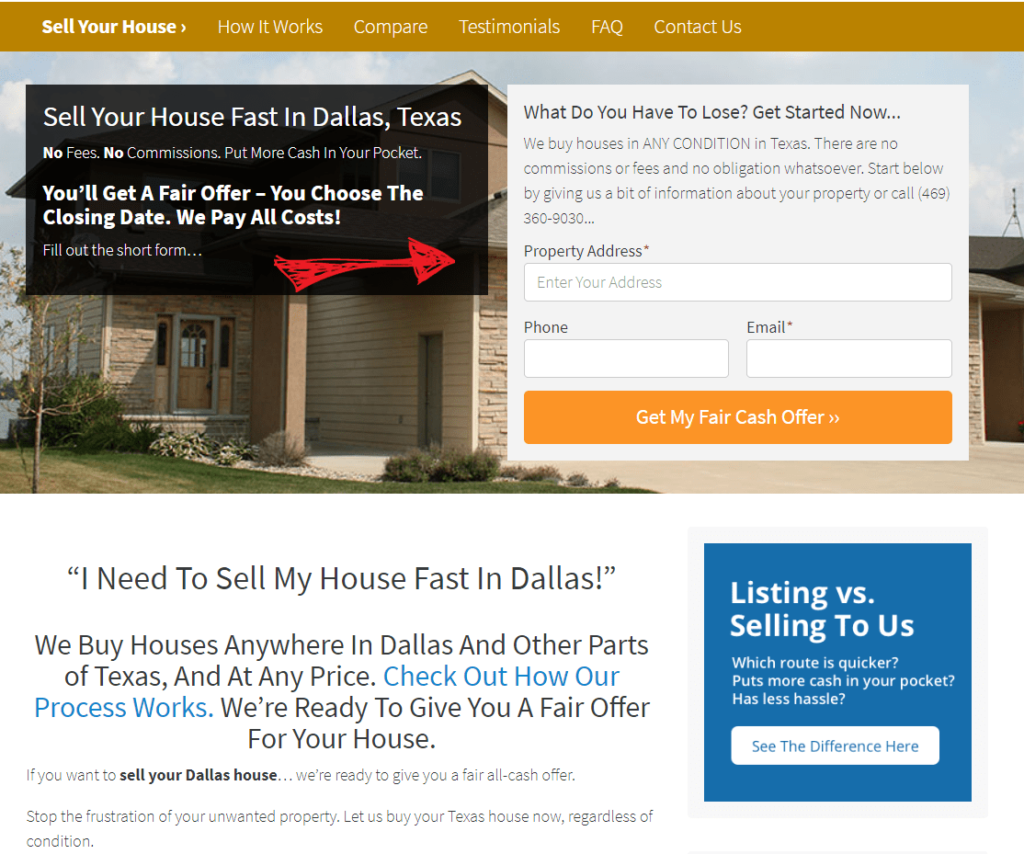

A website is a necessity but to be totally up front, a website by itself will not generate a ton of leads. A website only works when you send people there. But, if you don’t have a website you have nowhere to send people.

Check Out our Example Sell Your House Fast Website.

Though a website won’t build your business by itself, you’ll likely generate enough leads over time to pay for itself. Then, with the traffic you send to it from other sources, it will become a money-printing machine for you.

Here are the 3 main ways to get traffic to your wholesaling website:

- Search Engines.

- Online Ads.

- Direct Mail.

Search Engine Optimization for Your Wholesaling Website

When most people are looking for answers, they go straight to the internet to find them. If you build your website to have useful information that people want, they’ll find your website and some percentage of those visits will generate a lead.

To have your website near the top of the search engine results, you need to have information that is generally considered more valuable than what the competition is providing.

That’s where the keys to search engine optimization come in:

- Use the right keywords in the right places – You’ll want to use your targeted search term multiple times in the text as well as in various headers.

- Keep people on your website for longer – You can do this by writing longer content (notice how recipe pages always start with an annoying life story about how grampa used to make it growing up?) You can also add videos, infographics, and more content that engages a person to stay longer.

- Add related keywords to your content – Add in a variety of related search terms. Don’t just focus on “sell my house fast” but you can talk about “selling a house during divorce” or “how to sell inherited property quickly.”

- Update old pages – Search engines, especially Google, always favor newer content over older content.

Great Resources For Building Wholesaling Website

Free Real Estate Website How-To Guides.

Running Real Estate Ads on Facebook or Google

If a wholesaling website is your car, then ads are your gasoline. It’s nice to own a car but you won’t get very far without a budget to attract views.

The easiest place for you to start running ads would be on search engines such as Google, Bing, etc. Google dominates the search market with about 92% of traffic, but you might be able to get some cheap ads on Bing so don’t overlook it.

You’ve seen these ads on almost every search you run, so we won’t go into great detail here. But, the great thing about search ads is it’s extremely targeted so your ads will only show up when someone is searching for something specifically related to what you are willing to pay for.

So, if someone is searching “how to avoid foreclosure,” then you may want to target them with an ad for your services.

Social media advertising is a lot more complicated so we recommend starting with search ads first. With social media advertising for real estate, you need to target people based on their interests and then let the Meta algorithm refine the targeting over time. This requires a very in-depth tutorial.

Additionally, you can drop cookies on any person who visits your website and feed them ads as they use social media. So keep that in the back of your mind.

Direct Mail Marketing

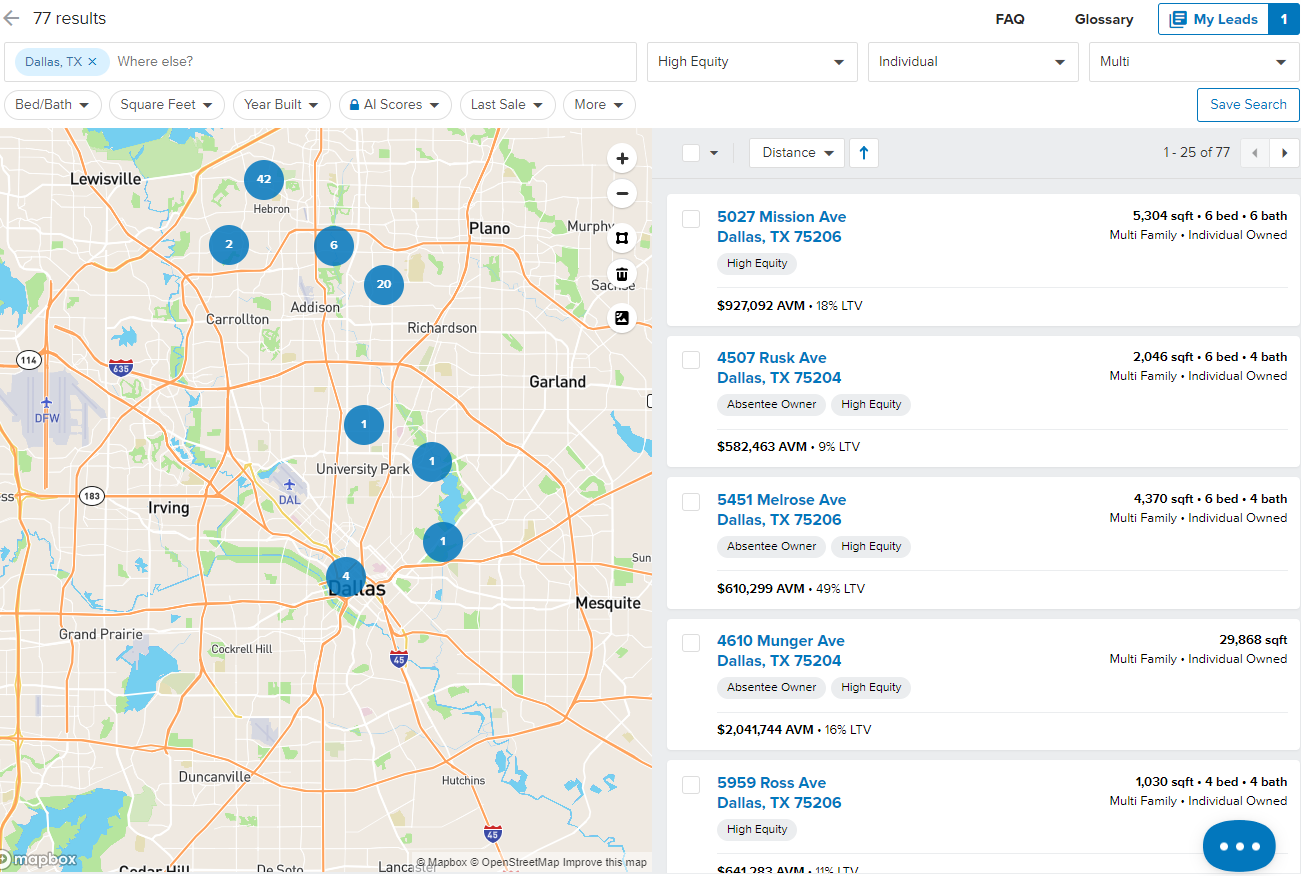

Direct mail marketing is the bread and butter for any real estate wholesaler. It’s the lifeblood of your business and will generate the vast majority of your leads and sales.

But, it’s very expensive.

Direct mail is also very effective and can yield immediate results if you have a properly targeted mailing campaign. But, with a poorly made direct mail campaign, you could be wasting your money entirely.

A few years back I sent out 1,000 letters in what turned out to be my most effective mailing campaign ever. I put two buildings under contract for a total of 15 units within one month. Those results are unbelievably atypical, but they highlight what a properly targeted mailing campaign can achieve.

There are 3 core components to a good direct mail marketing campaign for your wholesaling business:

- Have an excellent mailing list.

- Have great letters and postcards that don’t look scammy or spammy.

- Be consistent and send the campaign for at least 6 months.

If you are experienced and know how to build lists that you can use all year long, then we recommend Listsource. You choose the criteria then buy a spreadsheet of the addresses and owners’ addresses. You’ll likely spend $300-$700 on a list of 1,000 good addresses.

You can make your own mailers and postcards or send the list to a company online that can print and mail your letters for you.

If you’re newer to direct mail campaigns, then we recommend a service called RealeFlow.

Step 2: Real Estate Deal Analysis

So in our hypothetical world, you’ve created your website, are running some ads, started a mailing campaign, and now you’re getting leads. Great work so far.

Now you’ve got to master the art and science of deal analysis. Don’t be fooled, there is a science to deal analysis but there’s just as much art to it as science. But, with anything, you can’t put your own personal touch on the analysis until you’ve mastered the fundamentals of it.

If you are wholesaling a deal as a house flip, you will have fewer parts to analyze, but if you are wholesaling a rental property you’ll need to do a bit more analysis. Here are the steps you’ll need to take for both.

- Calculate the after-repair value

- Estimate the rehab costs

- Estimate the carrying and closing costs

- Calculate your maximum offer price

- Determine potential market rents

- Estimate the operating costs for a rental.

Calculating After Repair Value

The After Repair Value (ARV) is the potential price the property can sell for once all necessary repairs are made and once work has been done to bring it to its highest and best use. Do not confuse this with the appraised value or the tax-assessed value.

To estimate this price, you need to do what’s called a comparative market analysis. That’s where you look at other properties that match the size, age, and condition of the property you are looking at, and estimate the price from that.

Estimating the Rehab Costs

There are 4 main ways to estimate rehab costs, each has their pros and cons:

- Stick Method – List out each item and its costs. Then add them up. This method is very tedious and can be very accurate, but also can be way off if you forget a few items.

- Labor Hours Method – Purchase the materials and estimate the labor hours it will take to install them.

- Square Foot Method – Give a flat cost per square foot for the remodel. This is good for interior remodels but doesn’t do well with big-ticket items.

- Unit Pricing Method – Give an approximate cost per major part of the job.

Since each method works well in different situations, you’ll want to understand each method and decide where and when it’s best to use each. We do a full breakdown which lays it all out for you. Click the link below.

What are the Carrying and Closing Costs?

Closing costs include attorney fees, title insurance, recording fees, transfer taxes, and any other costs associated with the transfer. It’s easy enough to contact a closing attorney or title company to get an estimate of these.

One closing cost to pay attention to is adjustments for various expenses such as property taxes, water/sewer, and even oil. For example, taxes are paid quarterly but the adjustment will be based on who has to pay the bill. For example, if the seller already paid the taxes ahead then you will have larger closing costs to reimburse them for each day of the tax period you will own it. If you will pay the taxes you will get a credit.

Carrying costs are a little different. These are the costs the house flipper will incur for each month of ownership. Insurance, taxes, and interest on the loan will be the largest expenses but there may be others as well.

Calculate Your Offer With the 70% Rule

If you are strictly wholesaling real estate to house flippers, then your biggest rule of thumb is the 70% Rule. In layman’s terms, the 70% wholesaling rule is the total ‘all in’ cost a house flipper will pay as compared to the total after-repaired value (ARV) of the house.

So, if a house could potentially sell for $300k after it’s fully rehabbed, then the house flipper won’t want to pay more than $210k total for buying, holding, and fixing the house. The rest is their potential gross profit (not to be confused with net profit).

You can use this info to calculate your offer price.

First, estimate the repaired market value of the house. Then multiply it by 0.7 to get 70%.

Now subtract the rehab budget, your assignment fee, any close costs, and carrying costs.

The leftover number is your offer.

The problem with the 70% rule is competition quickly drives it up to the 75% rule, then the 80% rule. In the detached from reality markets of 2021/2022, people were paying above 100% believing that the market would bring them profit by the time the deals were ready to list.

So use this as a baseline then adjust for your specific market conditions.

Determine Market Rents

If you are wholesaling houses to flip, then you can skip ahead to Step 3. Otherwise, you still have two more steps to your analysis.

Estimate the operating costs for a rental.

The operating costs for a rental property are easy to get wrong. In fact, most people underestimate them substantially. Here are the several major categories of expenses that you absolutely must not forget to include

- Taxes

- Insurance

- Repairs and Maintenance

- Management (even if you self-manage, include this)

- Utilities

- Contract Services (pest control, outsourced lawn maintenance, snow removal, etc)

- Labor (not applicable to small buildings under 40-50 units)

- Make Readies (costs when tenants turn over)

- Advertising (costs to get new tenants)

- Admin (accountants, attorneys, evictions)

- Reserves (for future major expenses)

Alternatively, you can estimate costs with the 50% rule. The 50% rule states you take half the rent and assume that covers all your expenses (not counting interest on your loan) It’s a good approximation but actual operating costs vary widely from 50%.

Step 3: Putting the House Under Contract

The next step in the process is to make an offer and ultimately sign a contract. There are two key things to remember for this step

- You have to pay a deposit, even if it’s just $1. No real estate contract is binding without “consideration” which means you have to put cash toward the deal.

- Make sure your contract is assignable so you can flip it to an actual buyer.

This might be the shortest step but it is not inconsequential. Getting this step wrong can kill your deal and cause you to lose your deposit. We recommend downloading our Free Forms to get an idea of what forms you need to get started.

Step 4: Due Diligence

An inexperienced wholesaler will immediately start shopping the deal to potential investors. But, this is a bad idea unless you are very confident about the scope of work.

The circle of real estate investors in any market is relatively small and word travels fast. You may successfully pawn off a couple of bad deals on some newbie investors, but eventually, word will spread and you’ll be out of business.

For example, I was recently trying to purchase a 10-family deal from a wholesaler. He didn’t account for the cost of having to install a fire-panel system (estimated at around $30-$40k).

While this was an honest oversight, the wholesaler spent a lot of time and effort on this deal and also lost his deposit. He was out of business a year later. That’s why it’s best to be confident about the scope of work and the cost of that work.

Your long-term goal is to make investors see your numbers and trust them immediately. But it will take time to build to that. So, to start, you want to document everything and get quotes on absolutely anything you can and definitely on anything you aren’t sure about.

Then, build in a contingency budget because inevitably something does not go according to plan. If the scope or cost is more than expected, don’t be ashamed to renegotiate with the seller.

There are 3 main areas of due diligence to watch out for:

- Exterior

- Interior

- MEPs (mechanical, electrical, plumbing)

Exterior Diligence

When you’re doing diligence on the property, the first thing you want to do is walk the exterior. The entire exterior of the building is designed to keep water, insects, and animals out. It’s also designed to support the structure above and inside. So, when you’re inspecting your wholesale deal, you’re looking for anything that might jeopardize this.

The two biggest items are the roof and foundation. Check to make sure the foundation is straight and has few if any cracks. Some cracking is common but make sure there are no large gaps that would indicate significant settling.

Start by looking at the roof and chimney. If shingles are missing or are curled up on the edges, it is will need to be replaced. The chimney should be in good repair and nice and straight.

The siding should be intact. look for any cracks in any concrete or bricks. This can be a sign of structural problems. Some cracking can be very normal, so you need to determine if this is just a slight amount of settling or if it is due to a more serious structural issue.

You’ll also want to look at doors and windows to make sure they are intact and not allowing water to penetrate when it rains. You will also want to take note if they are vinyl windows or old fashioned single pane wooden windows which will likely need to be replaced.

The landscaping is also very important. The ground should slope away from the foundation and gutter downspouts should eject water away from the foundation, not directly toward it.

Interior Diligence

You’re looking for the cosmetic work that may be required to bring the property up to a buyer’s expectations. Make sure you are planning for upgrades to bring the property up to the area standards, maybe slightly better. But, be careful not to plan for over or under-upgrading a property.

Beyond that, you want to think of unique ways to improve the property and increase value. This could be something as simple as adding a closet to an office to make it a legal bedroom. Or it could be something like taking out a wall to create an open floor plan.

While you’re inside, think about any sagging in the floors and look for cracks in the walls. These two things will give you an idea if there are any structural issues that you may have missed when walking outside.

Mechanical, Electrical, and Plumbing Systems

You want to check the condition of the electrical service, electrical panel, wiring, plumbing, heating systems, cooling systems, water heater, and any other item that may last for a very long time.

Also, pay attention to service records and installation date stickers. Owners may neglect these items for 20 years, or not even realize they need to service their heating or cooling systems.

Step 5: Find a Buyer

Now it’s time to flip over to the “other side” of the transaction. It’s time to find a buyer. When the market was super hot like 2021 and 2022, any random wholesaler could show up at a networking event and offload their junk deals.

But, the market shifted in 2023 and will only get worse in 2024. That’s why you need to focus on building a solid buyers list.

In a perfect world, you should have a list of potential buyers before you put a property under contract. That way, when it’s time to find a buyer, it’s quick and easy. But, it also is hard to build a list when you don’t have any inventory to show.

Once you have a buyers list, all you need to do is market your properties via email and follow up with some phone calls.

Regardless, it’s never too late or too early to start building that buyer’s list, so let’s talk about list building.

Building a Buyers List

The first thing you’ll need is to create an actual list where you can capture the pertinent information.

You can start out in Excel, or get a cheap mail service such as Mailchimp. Starting from scratch you’ll want to keep costs down so it’s best to start with something free like Google Sheets or Excel. Eventually, you’ll want to transition to a service that allows you to email your growing list with the click of a button.

You’ll want to have categories to take down basic information such as name, email, and phone numbers. But, you’ll also want to include details on what type of deals they buy, how many deals they’ve done before, what towns or zip codes they work in, and any other criteria buyers may have.

Now that you’ve decided how you’ll contact them and where to store the info, it’s time to actually put people on the list.

Finding Buyers

Fortunately, this isn’t too difficult because any active investor won’t mind getting deals in their inbox. So the hard part is finding them in the first place.

There are two primary ways to meet investors – online and in person. In-person meetups and networking events work great because any personal connection increases your likelihood of doing business with a person. So, it’s a good place to start.

You’ll want to search Facebook, Meetup, Eventbrite, and possibly even BiggerPockets for local events. Try to get to a minimum of 1 or 2 events a week if possible. Not all markets are large enough to host so many events, so if you can’t fit a minimum of 4 events a month, just make it a point to attend every available event.

It’s also good to try to attend 1 or 2 conferences a year. These are a bigger time and financial commitment so they aren’t mandatory, but they are great for relationship building.

To build your list online, you can join various Facebook groups and start friending active investors who post. Also, wholesalers will post deals and you can take note of who’s interested in those.

Also, an overlooked way to build your list is to reach out to your existing list and ask them if they know anyone else who might be interested in joining the list. Referrals can be powerful.

How Big of a Buyers List Do I Need?

Bigger is always better, but the truth is there are wholesalers out there with 5 buyers who make a million dollars a year.

But more realistically you’ll need to manage a decent list that can absorb your deal flow. Maybe 25% of your list is in the market at any point in time. So, if your list has 10 good buyers, 2 or 3 might be shopping right now. Of those 2 or 3 buyers, your deal may only fit the criteria of 1 (or none) of them. Your particular deal may or may not fit the criteria for any of those buyers. And that one buyer may have 10 other potential deals on their desk right now.

So, you can see that if you want to maximize your odds of selling one of your deals, you’ll need to grow a list to a decent size to be able to put the odds in your favor.

As you can see, 10 buyers is probably not big enough. Based on the rough math, you probably want 50-100 buyers to maximize the chances a sale happens. You might get lucky with a few, but it’s always best to stack the odds in your favor.

After all, you don’t want to be flailing around at the last second trying to find a buyer!

Step 6: Close the Deal

There are two primary ways to wholesale a property – by contract assignment or via double closing.

A contract assignment is the classic way to wholesale real estate – it’s where you assign the contract to the buyer and they close on the property. You collect a fee for that.

The contract is pretty straightforward so we won’t get into that, but the biggest negotiating point is the assignment fee. Everything is negotiable in real estate, including the assignment fee and how you get paid.

In weak markets, the assignment fee might be relatively low and you may not get paid until closing. In hotter markets, you might be able to charge exorbitant fees and get most or even all of that fee upfront with the buyer having no guarantee to even close the deal.

How Much to Charge For the Assignment?

I’ve seen fees range anywhere from a few thousand dollars up to tens of thousands of dollars. It truly depends on how exceptional the deal is and how hot the market is.

Another point to negotiate is when you get paid. Many assignments will have an upfront fee and a fee at closing. But again, this is entirely negotiable depending on the deal and the market you’re in.

If the buyer will make $25k profit and do all the work for 6 months while you’re making $20k for a small amount of work, many buyers will walk from the deal.

On the other hand, if the buyer is making $200k profit in a month and you’re asking for $40k and spent a year negotiating this deal, a buyer may see it as fair and buy it anyhow.

So, pick a fee that is fair to both of you. It will help you grow your business and build your reputation.

Double Closing

Wholesaling isn’t legal everywhere, and it’s a grey area in some other places as well. So in those areas, they use what is called a double closing. A double closing is when you do back-to-back closings.

As the wholesaler, you don’t need to bring any money to the table because the attorneys or title company can make sure all the transactions are funded properly as long as the buyer has properly funded the deal. So what happens is you’ll legally purchase the property from the seller, then immediately sell the property to the buyer.

While this does increase the transaction costs, it has some benefits. The first benefit is that you did legally buy the property so you can legally sell the property, thus avoiding any anti-wholesaling laws (this is not legal advice. Please consult with a real estate attorney in your jurisdiction).

Secondly, it does allow you to hide some information from the buyer, primarily the price you paid. Mind you, they will find out the price most of the time, so this is only a short-term plan to hide what you’re earning on the deal. But it does allow you to get away with overcharging for fees.

Regardless, there may be a legitimate situation where you need to do it, so add this tool to your tool bag but don’t necessarily use it when you don’t need to.

When You Should (and Shouldn’t) Wholesale a Property

As a buyer, you have no responsibility to give a good deal to the seller. You are obligated to be truthful, not withhold critical information, etc. That being said, no one can last long in business who regularly takes advantage of other people. There also may be laws in place to protect the elderly from being taken advantage of by unscrupulous actors.

That’s why we recommend trying to find win-win situations. Your goal should be to find the problem and then solve that problem for the seller. If you can’t find a solution that helps the seller in some way, you shouldn’t engage in business with them.

The fact is their property will almost always sell for more when listed on the open market. So, they have to take a discount to work with you. Since they have to take a big hit on their selling price, make sure there is a good reason for it.

There are plenty of legitimate reasons to use wholesaling to help a person. Here are a few:

- When the seller needs to sell in a ridiculously short time frame and you know someone who can buy that fast.

- If the seller is facing foreclosure and you are willing to pay more than what they’ll get at a foreclosure auction.

- If the seller wants to avoid listing a property on the MLS.

Times You Should NOT Take the Contract

Pay attention to these times when you should walk away from the deal and not wholesale it, even if you could have made money:

- When they don’t truly understand what they are signing.

- If you have to trick or convince the seller to wholesale their residence rather than list it on the MLS.

- If you believe any other solution would be significantly better for the seller.

Risks of Wholesaling

Wholesaling houses sounds so easy and great, but it’s a lot more difficult than it sounds because there are a ton of pieces that have to come together for a real estate transaction to work out. By wholesaling, you are adding another piece to an already complex puzzle.

Additionally, you’re going to face a lack of trust on both sides of the transaction. The seller isn’t going to trust you because you aren’t a real estate agent and they don’t really understand what you’re trying to do or why. The buyers aren’t going to trust you because you have no experience in real estate and they have no idea if your budgets are accurate.

And that leads to the biggest risk of being a wholesaler…

Not Knowing Your Budget as a Wholesaler

The biggest risk you’ll face is messing up your rehab budget and therefore messing up your offer price. Do that a few times and you’re out of business.

Even if you do sell a deal with a bad budget, the buyer will quickly realize you left them with a lemon. It will tarnish your name and leave you with a short career as a wholesaler.

Not Finding a Buyer

The next biggest risk as a wholesaler is not being able to find a buyer. This is especially true if you’re very new. If you negotiated a very low deposit then there’s little risk to you other than waste time and marketing resources.

But, if you had a substantial deposit on the deal this can hurt quite a bit.

Not Finding Sellers

Marketing will be your number one cost, so it is also your biggest mistake if done improperly. This could come from marketing to the wrong households so you might have wasted thousands on lists and mailers with no results.

Another issue is that you are marketing to the right people, but you’re negotiating poorly or giving offers that are way too low. There’s a balance between low prices and actually getting an accepted contract.

Limiting Your Risk as a Wholesaler.

The best thing to do is limit your risk by keeping your earnest money or option payment to a minimum. In many cases, I’ve seen a property go under contract for as little as $1.

So, if you find that you’ve made a mistake, can’t find a buyer or something else pops up, you can simply dump the contract and just lose your option money.

Remember, it’s better to lose your option money than make a bad deal go through.

How Much Can I Make by Wholesaling Houses?

In real estate, this number always varies wildly. By that, I mean it ranges from $0 to 6 figures… per month.

I personally know people pulling in 6 figures a month by flipping wholesale contracts. On the other hand, I’ve seen many people come and go and never make a deal.

It all comes down to setting up good systems that allow you to automate your business and take down more deals. If you find amazing deals, it doesn’t take very much work at all to earn a ton of money.

Now It’s Time To Take Your First Step as A Real Estate Wholesaler

Are you going to start wholesaling properties? Sign up for our free system to help you become a real estate investor.

Eric Bowlin has 15 years of experience in the real estate industry and is a real estate investor, author, speaker, real estate agent, and coach. He focuses on multifamily, house flipping. and wholesaling and has owned over 470 units of multifamily.

Eric spends his time with his family, growing his businesses, diversifying his income, and teaching others how to achieve financial independence through real estate.

You may have seen Eric on Forbes, Bigger Pockets, Trulia, WiseBread, TheStreet, Inc, The Texan, Dallas Morning News, dozens of podcasts, and many others.

Leave a Reply