Invest where you want to invest, live where you want to live… That’s the mantra for Long Distance Real Estate Investing.

But it’s missing just one important point:

How do you invest in real estate out of state?

I personally have over 480 rental units and I manage my rental property from out of state, so I have a bit of experience in this topic. Investing out of state is actually quite simple, but that doesn’t make it easy.

So let’s dive into it in this step-by-step guide.

Why Should I Invest Out of State?

I recently sent a survey to 20,000 of my subscribers and the results are in…

Roughly 50% of real estate investors are looking out of state because the cost of real estate near them is too high or the returns are too low (or both).

Of those, most lived in the Northeast, West Coast, or in one of several high cost cities around the US.

That sums it up perfectly.

When you want to invest in real estate, but you can’t do it locally, that’s why you should look elsewhere.

If you live in a low cost city with super high returns, you should probably invest locally. Otherwise, it might be a good idea to look elsewhere.

Is Long Distance Real Estate Investing Risky?

Yes, long distance real estate investing is risky. But, then again, any kind of investing is risky.

Long distance or out of state real estate investing is definitely risky, but it doesn’t need to be any more or less risky than investing near where you live.

How? Well, it’s all about identify the risks and then finding ways to mitigate those risks.

Let me explain.

The first thing to do in this situation is identify the biggest risk factors with out of state real estate investing vs finding something local. Remember, local investing has a number of risks as well such as high prices, lack of inventory, low returns, etc.

Investing out of state limits those risks, but exposes you to new risks. If you can limit these risks then you can have a better investment overall.

Obviously, “distance” is the big obstacle, but that’s not very quantifiable, so we will dig deeper into it. Here are the top 3 I’ve come up with.

1. Managing Rental Property Long Distance

The biggest issue I have experienced is the difficulty with overseeing the rental property management long distance day-to-day. Tenants will let you know when there is a issue that directly impacts them, but rarely will they help you identify a problem before it becomes a problem.

For example, a tenant will call you if their faucet is not working, but they aren’t likely to call you and tell you a piece of siding is loose.

The tenant will definitely tell you if their door isn’t closing properly, but they won’t really care too much if a piece of fencing looks like it might fall over during the next storm.

These are the types of things you’d pick up on if you lived local to the property.

2. Difficult to Build Real Estate Teams Out of State

As investors, we need to work through other people. It’s just a fact of the industry.

But, building that team without meeting them or being able to oversee their work day to day can be very challenging.

It’s hard to build a close relationship with a real estate agent if you’ve never had coffee with them. It’s similarly hard to have a good contractor relationship when they have no idea who you are.

This is just one of the fundamental truths of human interaction. Things work better in-person.

3. Lack of Local Real Estate Market Knowledge

Any time an out-of-stater comes in, there will be a gap in knowledge between them and the locals who are investing there. It just makes logical sense if you think about it.

Of course, the people who live and work in that city are going to know it, even if it’s just from a lifetime of experience.

It’s nearly impossible to replicate this lifetime of market knowledge that a local will have.

The Steps to Low Risk Out of State Real Estate Investing

As with any list, you can make it as long or as short as you want. Obviously, each step will have a number of sub-steps, but we’re just trying to give an overarching path to follow.

The steps to long distance real estate investing are quite simple, but that doesn’t make it easy. So, follow and understand the basic steps, but try not to get overwhelmed at the number of complex sub-tasks in each step.

1. Figuring Out Which Market is Best for Long Distance Real Estate Investing

As soon as you make the decision to invest out of state, everything gets more complicated.

Instead of having to decide what town or city to invest in near you, since you are long distance real estate investing, you’ll have potentially hundreds or even thousands of places you could potentially invest. Talk about overwhelming!

The best way to narrow this down is to figure out exactly what you’re looking for and what risks you want to take or avoid, then put it all in a spreadsheet and narrow it down that way.

For example, if you already know you want long distance real estate investing as part of your portfolio, and if you are targeting student rentals you might want to find the top 5 metros for universities.

Then you can add in columns for other important categories. Maybe you only want to invest in states with growing populations. So you can make a column for that. Then you can see which of the top metros for universities is also in a state with growing populations.

As you add more columns, you’ll narrow the list down substantially until you’re able to pick a market.

2. Building a Long Distance Team

The second step is really key to long-distance real estate investing. Once you’ve picked your market, it’s time to build a team there. Without a good team, investing out of state becomes really challenging.

I know, I know… but how do you build a team when you don’t even have any property and you aren’t ready to make offers?

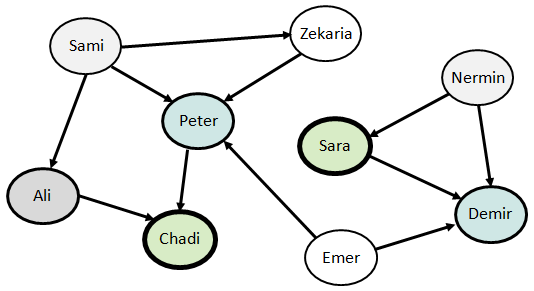

While you’re absolutely right that you cannot possibly build up your entire team at this point, I want to introduce you to the concept of relationship mapping.

In theory, everyone knows everyone else through a web of relationships. The issue is this web is not even or uniform… Some people are in a hub surrounded by a lot of people while others are on their own with few connections.

In the image above, you’ll see Peter and Demir are hubs while others only know a couple people. No matter what industry you are in, you want to know people at the hub of the network. This is especially true for long distance real estate investing since you will rely very heavily on the team you build.

You might otherwise call them an “influencer”.

Influencers in the real estate field will be real estate agents or property managers. They generally know everyone and if they don’t know someone, they know someone who knows them.

By building relationships with influencers, you’ll de facto be building a relationship with everyone else. At this stage, that’s adequate. Of course, you’ll grow that network over time but this is enough for you to get started.

3. Analyzing the Deals

This section quite literally could fill entire books and with LDR Real Estate, it’s no different. I’ll cover a few basics and point you toward other resources I have to give you more detail. Here are the most important 3 considerations

A. Equity and Value

The first and most important thing to ensure is the property will be worth more than what you got it for. This can be done in one of 3 ways:

Buy at a Discount

Negotiate a price far below the value on the open market. Generally you do this by targeting distressed sellers who have to sell quickly even if the price doesn’t favor them.

Think about it this way, if Esther has missed some mortgage payments, the bank may decide to take the home away from her and sell it on the market. But, if Esther has been living there for 10 years and has significantly paid down the mortgage, she may not owe very much afterall.

We all know that once her property goes into foreclosure, the fees will rack up and she will never see any of that equity. Unfortunately, there probably isn’t time for her to fix the house up and sell it on the MLS.

So, you offer a price well below market value, but it’s also far more than she’ll get if the bank takes it.

This is a win-win situation for everyone, and I discuss it more in this article about foreclosure real estate deals.

Forced Appreciation

In the industry, forced appreciation is any time you do something to the property that changes its value. Remodeling? That’s forced appreciation. There are dozens of ways to change the value of a property, and all of them can be considered forced appreciation.

For example, fixing a kitchen or bathroom can change the value of the home.

In multifamily homes, simply raising the rent can increase the value as well. I explain everything about forced appreciation here.

Market Appreciation

Ensure you are buying in a market that has good long-term potential. You’ll want to focus on areas that have a lot of migration, education, and limited ability to massively increase inventory.

It’s hard to predict what prices may do in any market, but in general, markets that grow tend to appreciate. So, always focus on areas that have a lot of growth both with businesses coming to the area as well as people moving to that area.

Remember, none of these are as easy to accomplish when you are out of state real estate investing. It’s important to have multiple avenues for profit and appreciation with any real estate deal.

B. Positive Cash Flow

It’s absolutely imperative that you buy real estate deals that have good positive cash flow.

Cash flow is simply the total income minus all expenses and bills. It is not profit, but just cash in vs cash out.

I never recommend buying a property for a long-term hold that doesn’t have positive cashflow upon completion of any rehab work. It’s generally a bad idea to buy a money-sink.

Read more about cash on cash return and how to calculate it.

4. Managing Out of State Rental Property

One of the scariest pieces of investing out of state or at a long distance is the management.

Most people opt to hire a property management company, but many (myself included) choose to self manage, even at a distance.

With property management, you can’t completely kick back and relax, but you can trust that someone is taking care of the big things, taking calls, collecting rent, etc.

With self management, you can save a ton of money but you’ll be stuck coordinating all the different pieces, contractors, inspections etc. It’s a lot of responsibility but can save thousands or tens of thousands if you have a decent sized portfolio.

For new investors, I recommend leaning on the expertise of a property management company.

Scaling Up Your Out of State Rental Portfolio

Now that you’ve found a good property with equity, good cash flow, and it’s properly managed, it’s time to scale up.

The key to scaling up is to have good systems and processes in place that you can replicate and repeat.

That’s the secret. It’s a long topic, but I break it down in more detail in this video training that you can sign up for below.

Eric Bowlin has 15 years of experience in the real estate industry and is a real estate investor, author, speaker, real estate agent, and coach. He focuses on multifamily, house flipping. and wholesaling and has owned over 470 units of multifamily.

Eric spends his time with his family, growing his businesses, diversifying his income, and teaching others how to achieve financial independence through real estate.

You may have seen Eric on Forbes, Bigger Pockets, Trulia, WiseBread, TheStreet, Inc, The Texan, Dallas Morning News, dozens of podcasts, and many others.

Leave a Reply